Given the whipsaw pandemic market swings and some lingering supply chain disruptions, the North American work truck industry is returning to a pre-pandemic "normal"—or so suggests Steve Latin-Kasper, NTEA’s staff economist and senior director of market data and research. And by "normal" he means 2022 will be "a slow-growth year—but still a growth year."

The initial impact of the pandemic on the commercial work truck industry was a downturn of some $23 billion, from $156.5 billion a year worth of revenues in 2019 down to $133 billion in 2020, Latin-Kasper reported in a Jan. 11 presentation on 2022 work truck industry market dynamics. Through 2021, the industry recovered much of that revenue, and NTEA expects the number will bounce back in 2022—somewhere in the $146 to $147 billion range. Keep in mind that is just a projection, Latin-Kasper advised, as NTEA’s 2021 numbers likely won’t be finalized until later in the year.

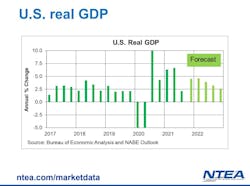

NTEA projects that U.S. GDP numbers will show an improvement of about 4.8% for the fourth quarter of 2021 after rebounding in the first half of 2021 compared to 2020. GDP then fell back in the third quarter as a result of supply chain disruptions.

“Expectations are 4.8ish for the fourth quarter, a little better in the first quarter of 2022, and then we start sliding down, according to most economists’ predictions going through the end of this year,” Latin-Kasper explained. “The reason for that is we are moving back towards the norm that was in existence prior to the onset of the pandemic, and we had gotten to the point where the U.S. economy was growing by about 2.5% a quarter.

So, more growth is expected, but that’s different from industry to industry and sector to sector, Latin-Kasper noted.

Chassis, vans, trailers

In total, for Classes 2-8 chassis sales in 2021 compared to 2020, NTEA reported 6.7% growth. However, it’s actually a 7.5% decline compared to pre-pandemic levels in 2019, Latin-Kasper noted.

“We are expecting an additional 2.5% growth in 2022 relative to 2021,” Latin-Kasper said. “That’s as a result of supply chain disruptions continuing to have a negative impact on production and shipments from the OEMs to the rest of the industry that wants to put a piece of equipment on those chassis. So, it’s a slow growth year, but still a growth year.”

NTEA expects to see the most growth in Classes 2 and 8, not quite as much in the middle, a little more in Classes 6 and 7 than the industry will likely see in Classes 3 through 5, he added.

The U.S./Mexico market reached a recent peak of a little more than 32,000 Class 2 through 7 straight truck chassis being sold per year towards the end of 2019 as a result of the recession, Latin-Kasper pointed out. The industry saw a large dip to a little less than 28,000 units per month at the bottom and about 32,000 units at the peak in 2019.

“We came out of the recession starting at the end of 2020, beginning of 2021, and we expected that to keep growing,” Latin-Kasper said. “As a result of supply chain disruptions starting to occur at the end of the first half of 2021 and getting worse throughout the second half of 2021, that had an impact on the annual percent change as well, and we started going in the wrong direction again.”

That was also true in the Class 8 segment of the industry, which saw that same turndown in the 12-month moving average.

“In Class 8, the industry didn’t get anywhere near close to its end of 2019 peak as we did in Classes 2 through 7,” Latin-Kasper said, noting that NTEA’s current data is as of October 2021. “That peaked at about 25,000 units per month and really crashed hard all the way down to 17,000 units per month before coming back up to about 20,000 as a result of supply chain disruptions.”

Latin-Kasper added that NTEA will know by the end of February where the industry ended 2021 when its December data is published.

“The supply chain disruptions impacted shipments coming from the OEMs to all of their partners in the sales channel before getting to end users,” he added. “We are seeing this more clearly in Classes 2 through 5 than we did in 6 through 8. Shipments clearly peaked at the end of the second quarter 2021, fell sharply in terms of annual percent change from growth of a little more than 30% down to growth of 10% as of October/November. We expect that to get a little worse on annual percent basis.”

NTEA projects that the industry will see some stabilization through the first quarter of 2022, with a more sustained growth path going throughout 2022.

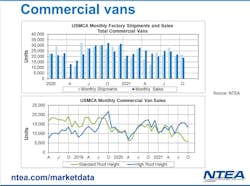

In the commercial van market, NTEA also saw supply chain disruptions and an end to growth, sales, and shipments through the second and into the third quarter of 2021, Latin-Kasper said.

“What is happening in total for vans is mostly because of standard roof height sales falling sharply, but high roof height sales starting coming down as well at the end of the second quarter and into the third quarter,” Latin-Kasper pointed out.

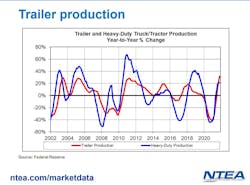

The trailer market did not experience that sort of decline yet, but it probably will taper off in the very near future, Latin-Kasper advised.

Diesel prices

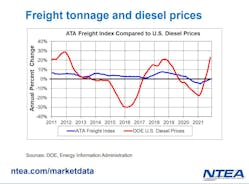

During his presentation, Latin-Kasper broke down diesel prices in terms of annual percent change and how they relate to American Trucking Associations’ Freight Index over time.

“If diesel prices are falling at a rate faster than freight shipments, or at least decelerating, what that means is profit margins are improving for all of the companies that run fleets,” he explained. “When diesel prices get up here and are growing faster than freight is, profit margins are getting pinched.

Freight growing steadily at this point is just one more indication that supply chain disruptions are improving, Latin-Kasper noted.

“Despite that good news, we’re seeing big changes in annual percent change terms in the price of diesel, which means that as good as life is in terms of shipments increasing for those fleets, revenues are going up but profit margins are getting squeezed,” he added. “That’s just one of the things that’s factoring into inflation increasing in the U.S., and that will continue to be the situation going forward.”

Latin-Kasper projected that the price of diesel will probably not hit a peak until the second quarter of 2022.

“It’s hard to call that one right now because it’s very difficult to predict what’s likely to happen with Russian production and their willingness to sell to the rest of the world,” he added, noting that political uncertainty between Russia and Ukraine will likely keep oil and diesel prices higher than they would have been otherwise.

Leading indicators

Moving forward, economic expectations are that the Federal Reserve is going to raise interest rates, Latin-Kasper said, adding that housing prices aren’t expected to fall and mortgage rates will continue to increase, slowly but surely.

The Consumer Price Index is currently up around 6% for the fourth quarter of 2021. That’s well beyond the Federal Reserve’s 2% target of inflation. So, even as most economists project the U.S. economy will come off that six-plus month-to-month inflation number and back down to about 4%, rate increases are expected, Latin-Kasper pointed out.

NTEA expects housing starts will likely grow about 2% by the end of 2022, and that’s a good thing for the commercial truck industry, Latin-Kasper noted.

“We have a long way to go before we get to the next recession in the heavy-duty segment of the industry,” he said. “That’s also true for the rest of the industry.”

Latin-Kasper also projected that the U.S. economy is expected to grow about 4% total by the end of the year, with the global economy lagging a bit.

“Everything we know about fleet demand indicates that it’s very strong and will likely remain strong going forward in 2022 as everyone plays catchup, as chassis slowly become more available, as the chip industry catches up to automotive sector demand, and other components become more readily available as well,” he said.

Chassis availability still lags far behind demand, and NTEA projects it likely won’t be until the end of 2022 before manufacturers catch up.

“Supply chain kinks remain a huge negative,” Latin-Kasper noted. “We are nowhere near back to normal supply chain function. Inflation is very bad right now, but that’s probably temporary and should dissipate as we get into the third quarter at the latest is what most economists are currently thinking.”

Latin-Kasper also pointed out that labor market demographic imbalances will continue to worsen through the decade.

“As we get to 2025, we probably hit the first year in a long time in which the U.S. labor market registers fewer new entrants to the market than retirees, which means the labor force actually declines a little bit in 2025,” he stressed. “As bad as labor market issues are right now, we haven’t seen the worst of it yet in all likelihood.”

COVID-19 and political unknowns also continue to cloud projections.

This article originally appeared in FleetOwner.com.