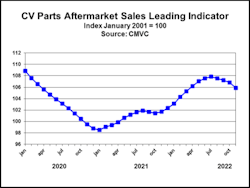

Commercial vehicle aftermarket sales decelerating, CMVC says

On the heels of a decrease of 0.4% in October, the Commercial Motor Vehicle Consulting's Parts Aftermarket Sales Leading Indicator (PLI) dropped another 0.9% in November.

The CMVC define PLI as "a short-term forecasting indicator of U.S. commercial vehicle parts aftermarket sales by signaling peaks/troughs and inflection/turning points in parts aftermarket retail sales due to changes in the fleet business environment as a result of changes in cyclical factors."

And this short-term indicator has declined for four consecutive months and "appears to be accelerating, signaling decelerating growth rates of parts aftermarket sales in the coming months," the CMVC said.

Compared to Nov. 2021, the PLI was 4.1% higher in Nov. 2022, but monthly growth rates from year-ago levels are slowing.

"PLI remains at a relatively high level, so it is signaling slowing growth in parts aftermarket sales in the coming months rather than decreasing parts aftermarket sales, but the risks to the parts aftermarket sales outlook are on the downside due to evaluated risks of a recession in 2023," CMVC stated.

Chris Brady, President of Commercial Motor Vehicle Consulting (CMVC), said: “Three of the six variables that make up PLI were negative in November and the factors that were positive, the improvements are slowing. The fleet business environment is changing as freight growth slows causing fleet capacity utilization to trend downward from evaluated levels with risks of fleet capacity utilization decreasing to low utilization rates as a result of evaluated risks of a recession in 2023. Low fleet capacity utilization implies a significant slowdown in the rate at which the truck population depreciates, thereby dampening parts aftermarket sales, and the actions taken by fleets in response to low truck utilization further dampen parts aftermarket sales. Currently, fleet capacity utilization is trending downward from evaluated levels, so the truck population is depreciating at normal rates spurring parts aftermarket sales.”