To strengthen its vocational powertrain portfolio, Allison Transmission entered a definitive agreement to acquire fellow Tier-1 supplier Dana Inc.’s Off-Highway business unit for $2.7 billion on June 11. Allison, the global market leader in fully automatic transmissions for commercial vehicles, plans to close the deal by the end of the year.

Dana’s off-highway segment provides drivetrain and motion solutions for multiple industries, including mining, construction, and forestry, and comprises approximately 11,000 employees with a footprint in 25 countries. Allison has around 3,700 employees worldwide and a market presence in over 150 countries.

“This acquisition marks a transformative milestone in our commitment to empowering our current and future customers with propulsion and drivetrain solutions that improve the way the world works,” said David Graziosi, Allison Transmission Chair and CEO. “We look forward to harnessing this momentum to increase value for all of our stakeholders worldwide.”

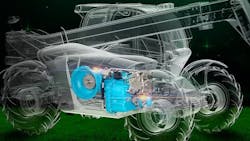

Along with traditional axles, driveshafts, pump drives, and transmissions (among several other components), Dana’s off-highway engineers and manufactures a slew of electric versions such as e-motors, e-axles, e-transmissions—and even an electrified slew drive. Many are part of Dana’s Spicer Electrified product line.

Allison already offers the eGen Power line of e-axles for several classes of trucks. The 100S model is being integrated into the McNeilus Volterra ZSL electric refuse vehicle (McNeilus is a subsidiary of OshKosh). The acquisition of Dana’s technology will likely help Allison gain a foothold in several other sectors as they slowly begin to electrify powertrains and drivelines.

Why Dana is selling

Dana announced plans to divest itself from the off-highway side last November to focus more on the light and commercial side, while also reducing costs and streamlining its balance sheet.

“This agreement represents a strategic opportunity to ensure the ongoing success of the business while allowing Dana to focus on our core priorities,” stated R. Bruce McDonald, Dana chair and CEO.

The waning enthusiasm for electric equipment has no doubt contributed to Dana’s decision to slim its business. With President Trump signing three Congressional Review Act resolutions to effectively end California Air Resources Board’s EV mandate, both on-highway and off-highway fleet customers now have the freedom to choose clean diesel and alt-fuel powertrains.

Furthermore, the off-highway side has taken a hit in recent years due to economic factors. As Fleet Maintenance partner site Power & Motion reported last year, demand for mobile equipment in the agricultural sector has been hurt due to lower crop prices.

Our take

As the economy is cyclical, sectors such as construction and ag will have boom times again and need more equipment. And someday, when the technology is more proven, these industries may have more desire to electrify operations. That could be anywhere from five to 10 or more years away, though Allison’s position allows the company to be patient.

In the short term, letting go of the off-highway side frees Dana up to focus solely on iterating and innovating new, more efficient, and reliable products for its OEM partners in the transportation sector.

All in all, this looks like a win-win for both sides and hopefully should benefit fleets now and in the future.

About the Author

John Hitch

Editor-in-chief, Fleet Maintenance

John Hitch is the award-winning editor-in-chief of Fleet Maintenance, where his mission is to provide maintenance leaders and technicians with the the latest information on tools, strategies, and best practices to keep their fleets' commercial vehicles moving.

He is based out of Cleveland, Ohio, and has worked in the B2B journalism space for more than a decade. Hitch was previously senior editor for FleetOwner and before that was technology editor for IndustryWeek and and managing editor of New Equipment Digest.

Hitch graduated from Kent State University and was editor of the student magazine The Burr in 2009.

The former sonar technician served honorably aboard the fast-attack submarine USS Oklahoma City (SSN-723), where he participated in counter-drug ops, an under-ice expedition, and other missions he's not allowed to talk about for several more decades.