Cost per mile update from ATRI: Fuel, M&R declines drive lower operating cost

The cost of operating a truck has dipped after three years of increases since the pandemic, according to the American Transportation Research Institute’s (ATRI) 2025 “An Analysis of the Operational Costs of Trucking,” with lower fuel costs as the main driver. Fuel per mile dropped 7 cents to 48 cents per mile in 2024 vs. 2023. That's still a dime higher per mile than in 2019, but 25% lower than in 2022, when it was 64 cents per mile.

The data indicated the overall cost of operating a truck shed one penny to $2.260 per mile in 2024, but removing fuel costs, the operational costs rose 3.6% (6.2 cents) to $1.779 per mile. This represents the highest costs ever recorded by ATRI for non-fuel operating expenses.

Driver-based costs were the primary reason, with driver wages getting a modest 2 cent bump to just shy of 80 cents per mile. Driver benefits rose 9 cents, a 4.8% increase.

Equipment lease and purchase payment cost per mile are still on the rise, up from 36 cents to 39 cents per mile. That's up 70% from 2015, according to ATRI data. Inflation over that time only accounts for about half that increase.

Repair and maintenance costs dropped for the first time since 2020, with the industry average just shy of 20 cents per mile in 2024. It was just over that the previous year.

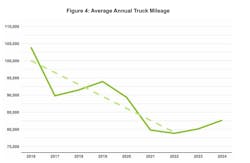

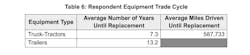

The study took stock of 178,091 combination truck-tractors that ran 14.08 billion miles, with trucks operating 268 days per year, up 243 days from 2023. Meanwhile, the average truck age fell to 3.4 years in 2024, with the average age of 53-ft. trailers rising to 7.4 years.

The increased operation could suggest that fleets are reducing their capacity, while the reduced truck age could suggest that fleets are receiving their truck deliveries after the truck shortages during COVID. Finally, ATRI found that the truck replacement cycle decreased in 2024 to 7.3 years from 7.5 in 2023.

Taken together, this could explain why R&M costs decreased, as the younger vehicles may be better equipped to handle the increased miles and need less maintenance, and fleets may be more inclined to trade their trucks in sooner instead of investing in repairs.

Repair and maintenance costs

From 2023 to 2024, R&M expenses fell by 2% from $0.202 to $0.198 per mile. This is close to R&M costs in 2022 ($0.196 per mile), but still two cents higher than the average R&M cost of 2021. However, this could change throughout 2025, as ATRI found that R&M costs rose by 2.8% in Q1 2025. This suggests that maintenance departments and independent shops may still be susceptible to the changing tariff landscape via parts costs, which was the main reason R&M costs dipped in 2024, ATRI said.

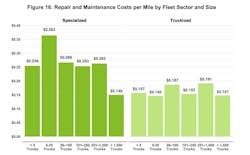

For specific fleet types, ATRI found that LTL carriers tended to have higher R&M costs per mile ($0.222 per mile). The 2024 expense was slightly lower than the 2023 average of $0.224 per mile. Smaller truckload carrier fleets tended to have higher costs, potentially suggesting that smaller fleets are forgoing some standard maintenance due to the freight market, ATRI said. But for larger fleets (over 100 trucks), they tended to spend the same on repairs and maintenance in 2024 compared to 2023.

Meanwhile, between truckload and specialized carriers, the latter tended to spend more on R&M per mile, with larger fleets seeing lower R&M costs, and smaller ones experiencing the highest.

These numbers are largely aligned with TMC and Decisiv’s latest “Parts and Labor Costs Analysis” report, which also saw a 1.6% decline in maintenance costs between Q4 2023 and Q4 2024.

At the same time, ATRI also found that the average number of miles traveled between breakdowns or unscheduled repairs also increased in 2024, from 37,700 to 38,249 miles.

“While numerous other factors impact mileage between breakdowns—including sector, truck procurement or age, preventative maintenance practices, and operating weight—this finding underscores the effectiveness of preventative maintenance, which generally improves mileage between breakdowns and reduces R&M costs,” the report explained.

Finally, one more element that tends to drive lower R&M costs is in-house maintenance. Yet in 2024, ATRI found that the industry handled maintenance in-house 59.8% of the time. Larger fleets, or those with over 1,000 trucks, tended to use 62.4% in-house maintenance, while fleets with 5-25 trucks only handled 48.2% of maintenance in-house.

Tire costs

While R&M costs dropped about 2% per mile, tire costs did the opposite by rising 2.2% to $0.047 per mile.

“This year-over-year change was below inflation (2.9%) during the same period, though somewhat surprising given the considerable decrease in oil prices,” ATRI said in their report.

But while surprising in context with oil prices, the increase in tire costs is in line with the overall trend of tire costs per mile increasing since 2021. Over the past three years, tire costs per mile picked up from $0.041 to $0.045, then $0.046, in 2021, 2022, and 2023, respectively.

About the Author

Alex Keenan

Alex Keenan is an Associate Editor for Fleet Maintenance magazine. She has written on a variety of topics for the past several years and recently joined the transportation industry, reviewing content covering technician challenges and breaking industry news. She holds a bachelor's degree in English from Colorado State University in Fort Collins, Colorado.