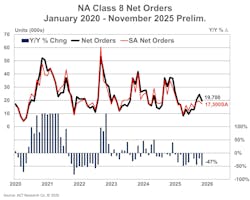

Class 8 vehicle orders saw a troubling drop in Nov. 2025 compared to Nov. 2024, with heavy-duty truck and tractor orders down 44% to 47% year over year, according to data from ACT Research and FTR Transportation Intelligence.

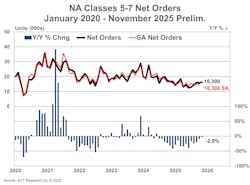

Specifically, ACT Research reported 19,700 Class 8 orders were taken this past November, down 47% YOY. Novemember is typically a strong month for orders. For Classes 5 through 8, ACT tracked around 36,000 net orders in November, which is down a third from the prevous November.

FTR Transportation Intelligence had a slightly higher estimate at 20,200 Class 8 orders. That's a 17% drop from October 2025 and 44% YOY. It's also down 30% from the 10-year average for November of 28,910.

In the last 12 months, FTR reported there have been 214,797 Class 8 orders total. What this means for many fleets' maintenace departments is that they will have to manage and service a larger amount of higher mileage trucks than in previous years, especally as they get closer or cross the 500,000-mile threshold.

Why Orders are down

FTR noted that concerns are rising for 2026. Cumulative net orders from September through November were down 36% compared to 2024. But the market is now clearer than it was a couple of months ago regarding tariffs on heavy-duty trucks and likely changes to the Environmental Protection Agency’s 2027 NOx rule.

Overall, the tariff structure raises costs but in a measured, targeted manner, supporting reshoring while avoiding significant short-term disruption to Class 8 sourcing and production. The expected elimination of the extended warranty requirements in the NOx rule would likely reduce costs substantially—perhaps by about half of the previously expected increase, according to FTR.

Even with modest tariff improvements and greater regulatory clarity, fleets have deferred replacement and expansion plans amid weak freight demand, according to FTR analysis. The firm also noted that the trucking industry continues to grapple with excess capacity, elevated financing and equipment costs, tariff volatility, uneven economic conditions, changing emissions requirements, and continuous margin pressure.

And even though November is typically the third-strongest order board month of the year, Carter Vieth, a research analyst at ACT, noted that is not the case this year.

“Despite last month’s announcement regarding EPA27 adding much-needed clarity for the market, the obvious bottleneck to stronger order activity is the lack of carrier profitability,” he stated on Dec. 2. “Spot rates continue to tread along the bottom, and while supply is coming out of the market, demand in key freight sectors is lagging.”

Medium-duty performance

ACT Research’s preliminary reporting shows November Class 5 to Class 7 orders in North America fell just 2.9% year over year to 16,300 (after an 11% drop in October to 15,500 units).

“Medium duty continues to be impacted by small businesses getting crushed by tariffs, uncertainty, and levels of consumer pessimism typically reserved for recessions,” Vieth said.

On-highway vs. vocational

Both vocational and on-highway segments posted month-over-month and year-over-year declines, according to FTR. Vocational outperformed on-highway on a year-over-year basis, reflecting continued, but cautious, demand heading into 2026.

2026 Outlook

Dan Moyer, FTR senior analyst, said: “So far, improved clarity has not been enough to offset a host of challenges—weak freight fundamentals, limited carrier profitability, elevated capital costs, and so on—that continue to keep fleets on the sidelines. Fleets are emphasizing cost control, maintenance discipline, and asset utilization over growth, delaying any meaningful rebound in equipment demand until economic and market conditions firm. For truck manufacturers and suppliers, forward visibility remains limited, and order activity is likely to remain uneven until freight volumes and rates show a sustained recovery.”

About the Author

Josh Fisher

Technology Editor

Editor-in-Chief Josh Fisher has been with FleetOwner since 2017. He covers everything from modern fleet management to operational efficiency, artificial intelligence, autonomous trucking, alternative fuels and powertrains, regulations, and emerging transportation technology. Based in Maryland, he writes the Lane Shift Ahead column about the changing North American transportation landscape.