Electronics remanufacturing is a growth area in the heavy duty commercial vehicle aftermarket

Marketplace changes are increasing demand for remanufactured alternatives to new electronic components.

Remanufacturing offers aftermarket customers an option of investing in replacement parts, usually priced significantly lower than the newer counterparts. Technological innovations across the value chain have helped the evolution of remanufacturing practices to different product segments and geographies that had never been explored before.

Frost & Sullivan has been actively tracking the remanufacturing market for various powertrain components. It has observed a very keen interest in the remanufacturing of electronics components for medium and heavy duty commercial vehicles (CVs) from various aftermarket participants.

While for most of the other segments, mainly mechanical, the continuous improvement in quality of OEM systems has come up to pose a serious challenge to remanufacturers. Electronic components, however offer a very good chance for business growth and expansion.

Electronic Components

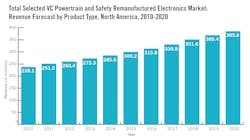

At the time of this writing (late December), Frost & Sullivan expects manufacturer-level revenues for selected Class 6 to 8 remanufactured electronic components to total approximately $285.6 million in 2014. It forecasts growth of by 5.1 percent annually over the next five to seven years.

Engine control modules (ECMs) are the largest segment by revenue, but electronic unit injectors (EUIs) are growing the fastest and will generate the largest share within the next year or two.

Electronics components studied include ECMs, transmission control modules, EUIs, anti-lock braking systems and electronic turbo actuators.

Strong Entry into the Aftermarket

A large pool of trucks equipped with these electronic components will be entering their second or even third life cycle, which translates to direct aftermarket replacement demand. High-quality OEM fitments ensure that very few of these fail while still under warranty and, hence, much larger replacement can be seen in the aftermarket, out of warranty.

Additionally, stricter government mandates over the years have also been a factor toward the increased penetration of electronics in CV systems.

Preparedness of the aftermarket no doubt will be tested, in terms of making available these components for replacement. Remanufactured options will only provide a competitive edge to market participants who have them in their portfolio.

Attaining Cost Competitiveness

Electronic components, still in an initial stage as far as replacements in aftermarket are concerned, can be costly to replace. This makes remanufactured alternatives, priced easily 30 to 40 percent lower, a very attractive option.

A larger share of vehicles at service shops for replacement of electronics are old enough to make the fleet owners be calculative of their spend on vehicle upkeep, making them look toward remanufactured electronic components as a viable option.

The push for selling remanufactured electronics also comes from channel participants who are looking to keep their margins intact while meeting the aftermarket demand.

Dealers can also be seen positioning these remanufactured parts in order to stay price competitive and fight competition from value brands, which, albeit new, do not offer the same quality and service levels as remanufactured parts.

For suppliers and fleet operators, the use of more remanufactured components for replacement needs also helps attain sustainability goals and builds a green image, which gives a marketing push as well.

Total Market

The total market for CV powertrain and safety remanufactured electronics is expected to grow to $385.5 million by 2020, with larger share of volumes coming from ECMs and EUIs. Since both components are controlled by the original equipment service (OES) channel, which have the required know-how in remanufacturing, this channel constitutes a majority share of the market revenues as well.

The OES control over cores will be key to their stronghold in the market. Their access to proprietary data, along with exclusive OEM supply partnerships, also gives them a position of strength in this space.

This grip could be seen loosening in the future as independent remanufacturers gain more access to cores and are able to attain technologies needed to remanufacture electronics.

While the market will see a promising demand, both in revenue and units, a constant pressure will be put on remanufacturers, both OEMs and independents, to keep prices in check. To keep the proposition of buying a remanufactured component intact, it will be important for participants to develop their practices toward attaining cost competitiveness – from core management to parts pricing – to compete against new product offerings.

Intensifying Competition

In North America, Detroit Diesel, Caterpillar, Cummins, Delphi and Robert Bosch are the biggest players in the aftermarket electronics remanufacturing space, fulfilling the majority of the market demand.

Players like Meritor, WABCO and Electronic Remanufacturing Company cater to the rest. They are expanding their remanufacturing businesses, further competing for the larger share of market demand.

The remanufacturing program by Detroit Reman (Detroit Diesel) has been one of the most successful, largely due to its early entry in the market in 2007 when it acquired DMR Electronics.

Future Outlook

Amid the growth environment, it is absolutely imperative for OES and independent market participants alike to develop core management systems that give them a sustainable advantage toward attaining price competitiveness.

The regulatory push toward incorporating more electronics components in vehicle systems will ensure increased demand for replacement.

In light of this positive outlook, it is expected that more OE participants will take part in the remanufacturing of electronics components for medium to heavy duty CVs, creating an even more competitive market.

Anuj Monga is a senior research analyst and team lead for Frost & Sullivan’s Automotive & Transportation global aftermarket research practice. He focuses on monitoring and analyzing emerging trends, technologies and market behavior in the global automotive aftermarket. Frost & Sullivan (www.frost.com) provides strategic analysis and consulting services, and offers corporate training and development services.