How leasing and repowering factor into electric truck TCO

The EV progress report has checked in with DHL, Dependable, and Ryder to get their trailblazing first impressions of the transition to EVs so far. While trial and error is sometimes the best teacher, analyzing data and estimating total cost of ownership using digital tools is the first step.

Theoretically, electric trucks should be better for the environment and a company’s bottom line—the ultimate win-win. To verify this, fleets will need years of data comparing the costs of their diesel operations versus EVs. But adopting these trucks doesn’t have to be a leap of faith, according to Fleet Advantage.

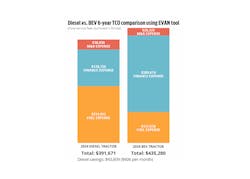

The company, which offers data analytics, equipment financing, and life cycle cost management, recently unveiled a new digital tool EVAN (Electric Vehicle Analytic Navigator) to estimate these assets’ total costs of ownership for individual fleets. The lifecycle cost analysis tool takes into account several variables, including equipment and charging costs, incentives, and maintenance cost per mile through a truck’s first six years, and provides a side-by-side comparison with a comparable diesel tractor.

Armed with this knowledge, fleets can better determine if adopting EVs now will ensure future profitability as well as sustainability.

“Everybody has different needs; they have different reasons for doing it,” noted Hadley Benton, EVP of business development at Fleet Advantage. “But ultimately, [electrification] needs to make economic sense at the same time, balancing that with reducing your greenhouse gas emissions and greening your fleet.”

That’s not always going to be the case. One EVAN example provided by Fleet Advantage found a food service fleet running in Florida would save $43,609 over six years to stick with diesel when leasing. In this case, the EV had a $0.03 better maintenance and repair (M & R) CPM over six years, and a decisive edge in fuel costs, with a $0.15 charge cost per kWh versus $4.13 diesel cost per gallon. These could not offset the 2024 BEV’s upfront cost of $236,000 (versus $145,000 for the diesel tractor) and ensuing finance fees.

The disparity was even more apparent when EVAN crunched the numbers for a Hawaiian grocery fleet. Leasing a diesel truck versus battery-electric would yield a 110% better TCO: $205,361 for the diesel; $443,889 for the BEV (due to much higher electrical costs in Hawaii).

Benton noted while Fleet Advantage has “billions of miles of data on diesel trucks,” they had to rely on data supplied by OEMs to make the EV assumptions. Even with more and more fleets adopting, the technology is “all very new,” he said.

Benton, who has specialized in fleet risk management for much of his 30-year career in the industry, explained all the uncertainty surrounding what type of battery chemistry will win out, or where fuel cells might see more adoption, “creates risk and drives the cost up.”

At some point, these questions will be sorted out and the risks will be reduced, allowing the advantages of EVs to stand out.

“The maintenance and repair costs are probably going to be about 25% less than a diesel from what we’ve seen so far—and could be as much as 30%,” Benton said. “The fuel cost advantage is probably about 40-45%.”

It’s not clear when OEMs will find ways to reduce upfront costs as they scale production, but when they do, those maintenance and fuel savings will provide a better TCO argument. So fleets should be analyzing where they currently stand and what duty cycles BEVs might flourish in, Benton argued. “You’ve got to consider your options and start thinking about what the future holds and set some goals,” he said.

In this respect, it’s much riskier to procrastinate until regulations force fleets to decarbonize and try to play catch up.

“By then it’s too late; they’ll be left behind,” he concluded.

See also: What EVs mean for fleet shop operations

Saving through repowering

One way to circumvent those high initial costs is to convert existing fossil fuel trucks to an EV. Cox Automotive found this allows their team to start learning about deploying EVs without incurring the usually steep learning curve costs.

“Early adopters are usually the ones that help fund the transition,” said Terry Rivers, VP of maintenance for Cox Automotive Mobility Fleet Services and sr. manager of vehicle services training. “It seems like with electric vehicles, that’s not the case.”

At least that’s not the case when Cox transplanted an electric powertrain into a disabled 2017 Sprinter van used for mobile maintenance.

“The motor blew and to replace, it’s about $25,000,” Rivers explained. “We converted it for $45,000.”

Cox was assisted by a repowering company called ZEVX, and Vanair installed four 5,000-w batteries in the back to run power tools, the electric welder, and an air compressor.

Rivers said it costs $133 less per week to power the truck, which went into service earlier this year, with electricity as opposed to diesel. At that rate, this Sprinter van will make up that $20,000 difference in about three years. But the cost savings don’t stop there.

“The electric savings are going to be found in uptime and maintenance,” he said. “There’s close to 10,000 moving parts on an internal combustion chassis platform and less than 1,000 moving parts on an electric.”

For mobile maintenance trucks and other work trucks that idle more often because they double as the worker’s ‘office’, the benefits of electrification are even more pronounced.

Running A/C in summer and heat in winter burns approximately a half-gallon of fuel per hour, or about $2/hour, Rivers said. EVs, by contrast, use resistor wires, similar to a hair dryer, to heat up quickly and up to 1,000% more efficiently, Rivers said.

Now that mobile tech doesn’t have to wait for the cab to reach a comfortable level and ends up being more productive, Rivers said.

He added starting cycles are also harder on the engine: “Warm-up cycles are the worst thing for internal combustion engines. First off, it destroys the engine—that cylinder head expands more than the cylinder block does further and faster at different rates, so it literally shreds the cylinder head gasket, causing undue wear and tear.”

Cox will alter the battery capacity for future conversions, Rivers noted.

“We put exactly what we needed in that truck, but what we should have done is about 150% of what we needed,” he said.

From a day-to-day perspective, this would allow a mobile tech to have enough range to take on another job and generate more revenue. Down the road, it will ensure the vehicle has the capacity to do a typical day’s work.

River expects batteries to lose upwards of 20% capacity after seven years. The truck would have a limited operating range and/or have to stop more often to charge if you keep it, and that decreased capacity also makes it harder to sell.

“In seven years, that vehicle is worthless to everyone,” he said. “Nobody will buy an EV with a bad battery, because they know it’s going to cost them $25,000 to $40,000 to put a battery in it.”

Overbuying mitigates this risk and is better for battery health. By not fully charging lithium-ion batteries and running them down, Rivers said a battery would only lose 10% capacity over seven years, not 20%.

Conversion is also far better at reducing emissions by eliminating new emissions at the manufacturing stage, noted Rivers, who has worked closely with EVs since 1997.

Thirty percent of a vehicle’s lifetime carbon emission output comes from manufacturing it, he said.

“You’re not carbon neutral on that vehicle for over 10 years,” Rivers said. “But if you take a vehicle you already bought, it’s a compound carbon emissions reduction. You’re carbon neutral in just a few years, three to five years max.”

About the Author

John Hitch

Editor-in-chief, Fleet Maintenance

John Hitch is the award-winning editor-in-chief of Fleet Maintenance, where his mission is to provide maintenance leaders and technicians with the the latest information on tools, strategies, and best practices to keep their fleets' commercial vehicles moving.

He is based out of Cleveland, Ohio, and has worked in the B2B journalism space for more than a decade. Hitch was previously senior editor for FleetOwner and before that was technology editor for IndustryWeek and and managing editor of New Equipment Digest.

Hitch graduated from Kent State University and was editor of the student magazine The Burr in 2009.

The former sonar technician served honorably aboard the fast-attack submarine USS Oklahoma City (SSN-723), where he participated in counter-drug ops, an under-ice expedition, and other missions he's not allowed to talk about for several more decades.