Three tire maintenance strategies to improve fuel efficiency

The bottom line to fuel economy starts at the bottom of the vehicle—with the tires. One challenge service personnel are faced with is how to provide accurate, meaningful input into the truck order process that will contribute to the company’s bottom line but not add to vehicle complexity. Three areas to focus on are:

- Tire selection

- Alignment

- Tire monitoring systems

Each area is directly related to fuel economy and the key is to understand how each affects dollars spent on fuel. For a deep dive into each, the North American Council for Freight Efficiency (NACFE) provides detailed confidence reports on these and many more topics. Below you'll find some of the key data and learnings from those and strategies to start shedding fuel costs immediately.

Tire selection

Low rolling resistance tires

Industry trends prove that more and more fleets are recognizing that the benefits of low rolling resistance (LRR) tires outweigh the challenges, and that LRR tires represent a good investment for improving fuel economy. However, there are concerns about the reduction in traction and a harsh ride. Fleets operating in northern states with adverse weather conditions have expressed the most concern about traction, and some have adjusted the specifications for trucks operating in those regions. As with any spec change, driver input should always be part of the process. The earlier management fields that feedback, the more successful the transition will be.

Duals or wide-base?

Fleets seeking to improve fuel efficiency through tires should not only consider rolling resistance, but also compare configuration. Would duals or wide-base singles provide the greater benefits?

At one time the benefits of wide-base tires compared to duals included lower rolling resistance, up to 1% reduction in overall vehicle weight, an equivalent upfront purchase price (one wide-base tire cost about the same as a similar pair of dual tires), and the potential for reduced maintenance.

On the other hand, the industry perceives the challenges associated with wide-base tires to include limited product availability, an increased cost of on-road breakdowns, a decrease in resale value, a reduction in the ability to retread the tires, and poor driver acceptance. Additionally, as wide-base tires have low rolling resistance, they face the same concerns around a decrease in traction and tread life as LRR duals. Recently, tire manufacturers have been able to reduce the rolling resistance of duals to nearly match wide-base singles. As a result, the take rate of wide-base singles has declined.

Currently, rolling resistance is not a publicly available data point for tires. Some major tire manufacturers, like Michelin and Goodyear, offer tools for comparing the fuel savings of different tires and brands, but their tools are not comprehensive and it can be hard to make comparisons between options. Fleet evaluations can prove less effective as fleets order new batches of trucks. Because other specs also change, it is nearly impossible to get an apples-to-apples comparison from one tire to another.

Total cost of ownership

Calculating the lifecycle cost of tire ownership is also critical. Traditionally, tire per-mile cost is defined solely in terms of initial purchase price, and as tire replacement may be more frequent with LRR than with non-LRR tires, the value of the LRR options has been underrecognized by the industry. ln fact, the cost of the fuel that a tire consumes due to its rolling resistance is five times greater than the initial purchase price of the tire. Rolling resistance accounts for 30% to 33% of the total fuel cost of a modern, aerodynamic, Class 8 truck, or about $0.012 per mile with dual tires. The typical upfront purchase cost of tires is only $0.04 per mile. But given the range in rolling resistance among dual tires on the market today, tires could be claiming anywhere from $0.14/mile to $0.28/mile in fuel costs. Put simply, fleets that are purchasing tires without considering the fuel expenditure impacts of those tires are going to be miscalculating the impact of their tires on their bottom line.

Wheel alignment

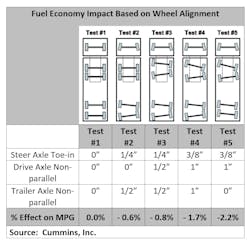

After selecting the correct tires, it’s important to maintain them to maximize fuel efficiency benefits. Precision truck tire alignment systems are required to eliminate tandem scrub and steer axle toe errors that contribute to increased rolling resistance and in turn reduced fuel efficiency. A tire that deviates only 1/4 degree from straight will travel 10 to 15 feet sideways for each mile the vehicle travels forward. Alignment issues may not be visible but still can cause the tires to scrub, increase aerodynamic drag, increase vibration, reduce stability, cause poor handling, and decrease the vehicle’s fuel mileage.

Cummins shared data from tests looking at wheel alignment that resulted in fuel efficiency losses of between 0.6% and 2.2%. Meanwhile fleets that have taken steps to ensure their tractors and trailers are aligned reported to NACFE that they have seen fuel savings in the 3% to 11% range.

Many fleets schedule alignment checks for the tractor at steer tire replacement. Some also have an alignment check as one of the steps in their preventive maintenance inspections, while others have a check connected to total operating mileage of the vehicle. Few fleets reported they had any scheduled checks on trailer wheel alignment.

It seems that trailer alignment is checked only following driver complaints. Fleets also say that improper alignment that can cause either well aligned tractors and trailers or those with alignment problems, to be worse after an alignment. It is, therefore, extremely important to be sure that fleets are using a robust the alignment process.

Tire pressure monitoring

Tire manufacturers agree that the most critical aspect of maintaining a tire is correct air pressure. Extensive research from the U.S. Department of Energy, among others, has found a direct connection between low tire pressure and reduced fuel mileage. Specifically, every 10-psi of under-inflation represents a 1% fuel economy penalty, due to the kinetic energy used to overcome the rolling resistance of the tire.

Read more: Managing commercial truck tires in real time

Maintaining proper tire inflation level reduces the risk of unexpected vehicle breakdown and damage and contributes to improved fuel efficiency, reduced tire wear, and longer casing life. On the other hand, tire underinflation leads to approximately 5% to 12% degradation in tire wear for an individual tire which is 10 psi underinflated, and 0.5% to 1.0% increase in fuel consumption for a vehicle running with all tires underinflated by 10 psi.

How bad is the tire inflation situation? Studies have shown that:

- About one out of five tractors/trucks is operating with one or more tires underinflated by at least 20 psi.

- About one in five trailers is operating with one or more tires underinflated by at least 20 psi.

- Nearly 3.5% of all tractors/trucks operate with four or more tires underinflated by at least 20 psi.

- 3% of all trailers operate with four or more tires underinflated by at least 20 psi.

- Approximately 3% of all trailers, and more than 3% of all tractors/trucks, are operating with at least one tire underinflated by 50 psi or more.

- Only 46% of all tractor tires and 38% of all trailer tires inspected were within +/- 5 psi of the target pressure.

Greater productivity and protection of assets can be obtained through effective tire inflation pressure management. Historical payback estimates for the implementation of tire pressure systems have ranged from less than one year up to approximately three years, with annual savings projected at $750 to more than $1,000 per vehicle per year.

Mismatched heights between tires is also an issue; studies have shown that a mismatch in the height of tires of as little as 5/16” can mean the taller tire will drag the shorter tire 13 feet for every mile traveled, or about 246 miles of drag per 100,000 miles driven. Tread on the shorter tire is being scrubbed off by this dragging, which results in increased rolling resistance and therefore a loss of fuel economy. Any reduction in tire rolling resistance improves fuel mileage.

Conclusion

Tire selection has a significant effect on operating cost with one-third of the cost being related to rolling resistance compared to initial cost. A slight premium for improved rolling resistance tires will be insignificant when compared to the tire initial cost. Wheel alignment may add an addition 2.2% to fuel economy which when using an average diesel pump cost, $4.00/gallon, traveling 90,000 miles/year will save about $500/year — much less than the premium tire with LRR tires. The addition of a tire pressure monitor system can also be offset when recognizing the importance of constant proper tire pressures.

Frank A. Bio, FABio Transportation Consultation founder and president, has been part of North American Council for Freight Efficiency since 2019 contributing to Confidence Report updates and various other assignments including autonomous and electric vehicles. Prior to retiring from Volvo Trucks as director of sales development – specialty vehicles and alternative fuels, Bio led Volvo’s sales force education and portfolio for alternative fuel and specialty vehicle. He also advised motor carriers considering alternative fuel vehicles and vocational trucks. Bio started his career in 1972 in the heavy-duty commercial vehicle industry, serving in a variety of positions including engineering, service, marketing, and sales.

About the Author

Frank Bio

Frank A. Bio, FABio Transportation Consultation founder and president, has been part of North American Council for Freight Efficiency since 2019, contributing to Confidence Report updates and various other assignments including autonomous and electric vehicles. Prior to retiring from Volvo Trucks as director of sales development – specialty vehicles and alternative fuels, Bio led Volvo’s sales force education and portfolio for alternative fuel and specialty vehicle. He also advised motor carriers considering alternative fuel vehicles and vocational trucks. Bio started his career in 1972 in the heavy-duty commercial vehicle industry, serving in a variety of positions including engineering, service, marketing, and sales.