CALSTART reports breakthrough growth for ZETs. What does that mean for fleets?

U.S. Medium- and heavy-duty zero-emission truck (Class 2b-8) deployments are growing, but still have a long way to go to make any substantial impact on emissions, according to data compiled by CALSTART. This was the third publication in CALSTART’s Zeroing in on Zero-Emission Trucks series.

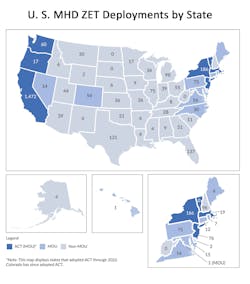

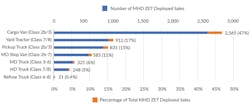

The latest market update, funded through the California Air Resources Board (CARB) Hybrid and Zero-Emission Truck and Bus Voucher Incentive Project (HVIP), found that 3,510 medium- and heavy-duty zero-emission trucks (ZETs) were deployed in 2022, a 78% increase over the previous five years (1,973 ZETs deployed from 2017-2021).

CARB recently approved a rule to eliminate sales of fossil-fuel powered MHD in California by 2036, with a goal of 100% ZETs by 2045. The state accounts for more than a quarter of all ZETs deployed since 2017.

At the other end, Class 8 ZETS are poised to experience huge growth as well. Schneider is poised to operate 92 Freightliner eCascadia BEVs by the end of this year. By 2025, Schneider plans to reduce CO2 per-mile emissions by 7.5% and 60% by 2035.

“The integration of nearly 100 zero emission vehicles is an important milestone for Schneider as we are moving beyond the battery electric truck testing phase to running an operation at scale,” said Schneider President and CEO Mark Rourke. “In combination with rail movement, we can offer our intermodal customers meaningful emissions reduction value by utilizing BEV [drayage] trucks.”

Looking ahead

How fast this breakthrough growth to a meaningful percentage of commercial vehicle fleets depends on the availability and ease of acquiring incentives, the industry’s ability to scale charging infrastructure, and OEMs’ ability to bring down the costs of EVs.

Incentives and infrastructure

Along with state incentives such as California's HVIP program, fleets can expect to leverage more funding help from the Inflation Reduction Act (IRA) and Infrastructure Investment and Jobs Act. The IRA specifically allows up to a $7,500 tax credit for light-duty commercial vehicles (14,000 lb. GVWR) and $40,000 per medium- and heavy-duty (>14,000 lb. GVWR).

Hydrogen fuel cell trucks, thought to be the most viable way to eliminate long-haul truck emission due to range and fueling advantages over electric trucks, may benefit most from the IRA.

“The biggest winner in the energy market for the IRA was hydrogen,” said Andy Marsh, president and CEO of Plug Power, a provider of green hydrogen and fuel cell solutions. This is because companies can stack hydrogen-related incentives. By 2025, Plug plans to produce 500 tons of liquid green hydrogen per day, and double that by 2028.

McKinsey estimated that up to 15% of fleet vehicles could be electric by 2030. Though by then, 13 million chargers would be required to provide them energy. In this scenario, fleet EVs would consume 230 terawatt-hours of power per year, which equates to 6% of total U.S. power generation.

Scaling and adoption

While speaking to investors in late May, Ford CEO Jim Farley projected that electric vehicles would reach cost parity with vehicles powered by internal combustion within 12 years. This was referring to a third-generation $40,000 EV, which could leverage lithium iron phosphate batteries. Labor and distribution costs are also expected to be “dramatically” lower, Farley said.

Ford Pro currently offers two commercial EVs: the Ford F-150 Lightning pickup and E-Transit cargo van.

According to Samsara’s State of Connected Operations 2023 report, 67% of connected operations leaders surveyed said they will use battery-electric vehicles or equipment in 2023. The survey canvassed 1,500 physical operations leaders across the globe. More than half stated their carbon reduction goals were motivated by regulatory requirements. Another primary driver listed was reducing carbon emissions to improve employee retention and recruitment.

To stay up to date on fleet electrification, sign up for our Market Moves Electric Vehicles newsletter here.

About the Author

John Hitch

Editor-in-chief, Fleet Maintenance

John Hitch is the award-winning editor-in-chief of Fleet Maintenance, where his mission is to provide maintenance leaders and technicians with the the latest information on tools, strategies, and best practices to keep their fleets' commercial vehicles moving.

He is based out of Cleveland, Ohio, and has worked in the B2B journalism space for more than a decade. Hitch was previously senior editor for FleetOwner and before that was technology editor for IndustryWeek and and managing editor of New Equipment Digest.

Hitch graduated from Kent State University and was editor of the student magazine The Burr in 2009.

The former sonar technician served honorably aboard the fast-attack submarine USS Oklahoma City (SSN-723), where he participated in counter-drug ops, an under-ice expedition, and other missions he's not allowed to talk about for several more decades.