Trump: 25% Heavy truck tariffs set to hit Oct. 1

President Donald Trump announced yesterday that he is imposing a 25% tariff on foreign-made heavy-duty trucks (GVWR>26,000 lbs.) on Oct. 1. Previously, these trucks were exempt from tariffs. He made this decision based on a Section 232 national security investigation.

On Truth Social, Trump wrote:

“In order to protect our Great Heavy Truck Manufacturers from unfair outside competition, I will be imposing, as of October 1st, 2025, a 25% Tariff on all “Heavy (Big!) Trucks” made in other parts of the World. Therefore, our Great Large Truck Company Manufacturers, such as Peterbilt, Kenworth, Freightliner, Mack Trucks, and others, will be protected from the onslaught of outside interruptions. We need our Truckers to be financially healthy and strong, for many reasons, but above all else, for National Security purposes!”

The American Trucking Associations, which represents 37,000 trucking companies, has opposed the increase, submitting a comment on Section 232 in May that notes cross-border freight creates the equivalent of 100,000 full-time trucking jobs.

According to the Economic Policy Institute, one durable manufacturing job creates 7.4 indirect jobs.

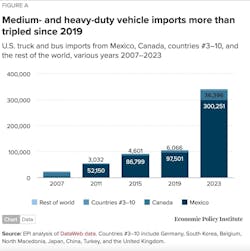

The trade group is still trying to figure out what parts will be subject to tariffs, but previously noted 60% of Class 8 trucks bought in the U.S. are made and assembled here, with Mexico responsible for the remaining 40%. Hino makes Class 8 trucks in Woodstock, Ontario, though sells less than 50 per year.

After Trump’s announcement, ATA President and CEO Chris Spear stated to members:

“In line with the Administration's goal to revitalize U.S. manufacturing, we support the goal of creating domestic jobs. As you know, however, the trucking industry has been navigating an extremely challenging operating environment, with rising costs and soft freight volumes. We are assessing the impact that these new tariffs could have on truck prices as manufacturers look to shift production from Mexico, as permitted under USMCA, to the United States — costs that motor carriers small and large will be forced to absorb.”

ATA and other groups have called for a repeal of the 12% Federal Excise Tax on new trucks, which Spear called “a counterproductive, outdated, and punitive tax that hurts U.S. manufacturing and penalizes truckers for investing in new, American-made equipment.”

In April, Congressman Doug LaMalfa (R-CA-01) reintroduced the Modern, Clean, and Safe Trucks Act (H.R. 2424) to repeal the FET.

The trucking industry has also asked for the EPA to pause its 2027 low-NOx rule until 2031. Before tariffs were an issue, experts estimated the new engine technology needed to meet the stricter NOx emissions and warranty requirements would add at least $20,000 to a new Class 8 diesel truck’s cost.

About the Author

John Hitch

Editor-in-chief, Fleet Maintenance

John Hitch is the award-winning editor-in-chief of Fleet Maintenance, where his mission is to provide maintenance leaders and technicians with the the latest information on tools, strategies, and best practices to keep their fleets' commercial vehicles moving.

He is based out of Cleveland, Ohio, and has worked in the B2B journalism space for more than a decade. Hitch was previously senior editor for FleetOwner and before that was technology editor for IndustryWeek and and managing editor of New Equipment Digest.

Hitch graduated from Kent State University and was editor of the student magazine The Burr in 2009.

The former sonar technician served honorably aboard the fast-attack submarine USS Oklahoma City (SSN-723), where he participated in counter-drug ops, an under-ice expedition, and other missions he's not allowed to talk about for several more decades.