Using predictive maintenance to schedule downtime

Today, when a commercial vehicle is broken, it goes into the maintenance bay for repair leaving it unavailable for use. But the industry has begun shifting its focus to predictive maintenance and vehicle prognostics, preventing unscheduled downtime from leaving fleets short on assets.

“The next step of the evolution is that we start doing prediction based off of use,” explains Scott Bolt, vice president of product management for Noregon Systems. “For instance, in our roadmap, we have condition-based maintenance to where you are basically planning to avoid things. Between avoiding a problem and having a breakdown is your predictive phase. Then, the final phase is maintaining the vehicle so it doesn’t break. Today, we’re in the fix-it-because-it’s-broke phase.”

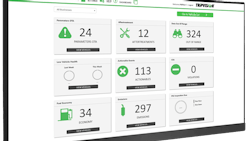

Noregon has developed TripVision Uptime to help fleets better predict in real time when an asset is going to break and schedule out vehicle downtime. During a virtual walk-through demonstration, Alec Johnson, product manager at Noregon, explained that TripVision will show fleets different types of scoring on the current health of the vehicle, safety, and predictive health. The technology informs a fleet dispatcher, maintenance manager, or technician how a truck is operating today and when it has a critical issue that will significantly degrade performance. TripVision also offers updates on compliance, safety, accountability (CSA) violations, emission faults, and fuel performance.

Fleet maintenance managers or senior leadership can also leverage TripVision to see whether staff members are paying attention to predictive faults and if potential problems could have been mitigated.

“You can retroactively go back, look at the predictive faults, and then see that this actually did escalate, and it was predicted beforehand,” Johnson says. “Leadership can then say, ‘I need to work with my team to get them to be more proactive.’ And rather than just focusing on the trucks that are broken down today, they can also start spending some time looking at those predictions and trying to route the trucks that aren’t so critical now but will likely deteriorate fairly quickly.”

As part of its dashboard feature, TripVision also provides a high-level overview of issues affecting the health, safety, or performance status of fleet vehicles. This feature, Johnson notes, is particularly impactful for larger fleets and OEs.

“You could drill in some issues that are most important to you,” he says. “Maybe you’re trying to reduce costs, or you care a lot about fuel economy, or you’re trying to be really forward looking and mitigate issues before they arise. What’s cool about TripVision and our algorithms is the more data we aggregate, the more predictions we can make for your trucks. And the more data we aggregate, the more we can fine-tune our algorithm.”

When it comes to analyzing the data, fleets can access Noregon’s platform via their telematics solution. Noregon is then able to call out important data points and look at the trends down to specific makes and equipment models. On top of that, master mechanics at Noregon also scrutinize the data to determine when certain issues are expected to escalate.

Managing fleet TCO

A challenge that remains constant for fleets is managing their trucks’ total cost of ownership (TCO), with maintenance and repair (M&R) as the highest variable and volatile cost of a fleet operation, notes Matthew Wiedmeyer, director of Fleet Services at Fleet Advantage. Fleet Advantage provides leasing solutions, asset management, and consulting for Class 8 truck fleet operators.

“M&R costs vary from truck to truck, but history tells us there are specific core areas where M&R becomes very costly, especially in vehicles that are approaching 300,000 miles,” Wiedmeyer explains.

According to Fleet Advantage, high-cost M&R items include:

- Equipment issues combined with warranty expiration

- Emissions issues

- DPF cleaning or replacement

- Brakes issues

- Lack of follow-up repairs

- Tire wear

- Unforeseen breakdowns

Tires, tubes, liners, and valves have been estimated to take up as much as 43 percent of a fleet’s M&R expenses, while other areas such as preventive maintenance (12 percent), brakes (9 percent), and exhaust systems (6 percent) are also significant areas for repair expense, according to Fleet Advantage.

“The influence of technology and innovation, including data and analytics, has been among the most impactful developments in the fleet transportation industry over the last several years,” Wiedmeyer points out. “Through advanced technology and reporting platforms, data analytics are now completely reshaping how companies with transportation fleets run their businesses and how they manage M&R expenses overall.”

Wiedmeyer also notes that because the trucks of tomorrow — many of which have already started to appear on the roads today – are more technically sophisticated, technicians will need to learn how to maintain more advanced systems.

“Recruitment strategies should be designed to showcase and redefine what it means to be a technician in the fleet transportation industry,” Wiedmeyer says. “It’s no longer about dirty rags and greasy tools, but instead moving toward analytics, computers, and even engineering. In fact, some maintenance procedures on trucks will soon involve downloading remote software updates similar to how we download updates to a smartphone today.

“Having adequately trained technicians on staff is essential to running an efficient transportation fleet,” he continues. “Their time is critical and having improperly trained technicians can also eat into the bottom line.”

Moving forward, Noregon’s Johnson expects that predictive maintenance will continue to evolve with more expansion of sensors and components that will inevitably allow Noregon to make more predictions for fleets.

“I anticipate us making predictions on a multitude of different types of sensor values, but right now, we have the ability to make predictions on fault information,” he says.

Johnson projects that down the road, algorithms also will become more of a focal point.

“Where today it is a partnership between man and machine, I think as we move forward with the algorithms, AI [artificial intelligence] will get smarter and smarter and be able to make predictions more autonomously,” Johnson points out.

About the Author

Cristina Commendatore

Cristina Commendatore is the Executive Editor of FleetOwner magazine. She has reported on the transportation industry since 2015, covering topics such as business operational challenges, driver and technician shortages, truck safety, and new vehicle technologies. She holds a master’s degree in journalism from Quinnipiac University in Hamden, Connecticut.