Market insights with Mike: Recent trends in vehicle miles driven during COVID-19

With millions of Americans working from home due to office and school closures, many in the industry are wondering about vehicle miles traveled (VMT) statistics – and rightly so. VMT statistics are correlated with the health of the aftermarket industry, and this makes intuitive sense – the more miles driven, the more that maintenance, repair, and replacement of vehicles will be required.

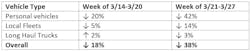

But what about the past few weeks, since COVID-19 has whipsawed the economy? In my local neighborhood, there is certainly less traffic, but what about the entire nation? Transportation data provider INRIX reports that overall daily national traffic volume for consumers, local fleets, and long-haul trucks was down 38 percent for March 21-27, relative to February 22-28.

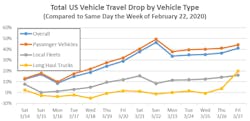

Based on anonymous speed/location data reported in real-time from all road types for more than 100 million trips per day in the United States, INRIX found that relative to typical daily travel (Friday, February 22):

- Nationally, personal travel dropped by 38 to 48 percent during the workweek.

- Long haul truck travel showed its first signs of decline by Thursday, March 26, down 20 percent on Friday, March 27.

- Local area commercial travel declined steadily throughout the week, reaching 16 percent on Friday, March 27.

- San Francisco and Detroit’s personal travel have both dropped by nearly two-thirds overall.

- Michigan had the largest statewide decrease in personal (56 percent) and long-haul truck (41 percent) travel.

The week of March 21-27 saw further reductions in vehicular travel than the week of March 14-20, both relative to the week of February 22-28:

Metropolitan areas with the highest reductions for Friday, March 27 (relative to Friday, Februacy 22) include Detroit (down 62 percent), San Francisco (down 54 percent), Seattle (down 52 percent), and New York City (down 48 percent). Note that San Francisco was the first major city to ‘shelter-in-place’). These trends are also illustrated in the chart below:

How long the decrease in VMT will persist is uncertain, particularly in the face of lower gas prices, the upcoming summer driving season, and aversion to flying given social distancing. What we have seen historically, though, is that aftermarket spend is sustained on as automobile owners keep their vehicles longer. This may be even more pronounced given temporary shutdowns of motor vehicle factories.

Information provided by Auto Care Association

About the Author

Mike Chung

Director, market intelligence at Auto Care Association

Mike Chung is director, market intelligence at Auto Care Association. With more than a dozen years of experience in market research, Chung and his team provide the industry with timely information on key factors and trends influencing the health of the automotive aftermarket and serving as a critical resource by helping businesses throughout the supply chain to make better business decisions. Chung has earned several degrees, including a Bachelor of Science in chemical engineering from Massachusetts Institute of Technology (MIT), a Master of Science in environmental health management from Harvard University and a Master of Business Administration with a concentration in marketing from Montclair State University.