Market insights with Mike: Updated macroeconomic and impact trends

As the industry has watched automotive travel stats, we have been keeping an eye on other economic indicators. It’s hard not to compare current indicators to the Great Recession of 2008. We have learned that the Consumer Confidence Index (CCI) has dropped to 86.9 for April 2020 (the orange line in the chart below; down 34 percent from 130.7 in February 2020) – its lowest level since 2014, and at a steeper rate than in the 2006-2008 timeframe.

Gas prices have also dropped considerably in recent weeks (albeit for a variety of reasons – we will write more about the oil markets and its impact on the automotive industry in the coming weeks). As represented by the gray line in the chart below, the U.S. national average price for gasoline has dropped 23 percent from in December 2008.

Since 2013, Auto Care has partnered with Northwood University to collect economic sentiment data across the auto care industry through the Business Confidence Index (BCI). In the chart below, BCI (gray line) is plotted with CCI (orange line) – the correlation between the two is particularly pronounced in 2020, as they both drop significantly together.

So what do these indicators foreshadow for the coming weeks? It’s hard to say for sure, but we are seeing some signs of increased activity in automotive travel, and activity in some industrial sectors.

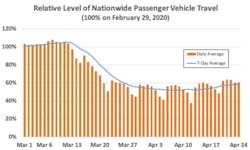

As we have cited in past columns, traffic has slowly crept up. The chart below plots the change in requests from Apple product users for directions, with January 13, 2020, as the baseline (=100). This chart displays the U.S. national trend in the solid red line, with 11 major cities as dashed lines. (Not pictured: a plot of state-level data shows that U.S. states follow the same pattern).

This pattern mirrors the national traffic pattern as captured by INRIX:

The gradual uptick in these stats makes intuitive sense as some areas are easing restrictions (and as Spring/cabin fever builds). So where are people going? The next chart shows the relative activity in foot-traffic for half a dozen large retailers.

As restrictions are being eased, the incremental increases in visits to Target, McDonalds, Walmart, and Costco make sense, as does the much higher activity at Home Depot: “Spring for home improvement stores is by far the busiest time of year, generating about 30 percent of annual sales … the spring season is to Home Depot and Lowe’s what the Christmas period is to Macy’s or Best Buy,” (Phil Wahba, Fortune). Put another way, “Bring on a pandemic and, suddenly, everyone’s Bob the Builder … ‘Every honey-do list is getting done,’” (Petula Dvorak, The Washington Post).

You may be able to relate to this, particularly if you have been staying at home for the past month – it becomes easier to notice imperfections around the house, think about refreshing the walls with a fresh coat of paint, and do springtime yard work. Nathan Shipley of NPD Group notes that the increase of do-it-yourself work is partly “due to demand softness last year because of poor weather, the other part is related to consumers having time at home to tackle DIY projects. From hard-core enthusiasts resuming work on the old project car in the garage, to lite-DIY consumers just looking for something to do, the paint and body repair categories are benefitting right now,” (Aftermarket News).

Pivoting back to the auto care industry, we have continued to collect responses to our survey regarding economic impact on the auto care industry. Impact and sentiment did not change remarkably from the first half of April to the second half of April. As illustrated below, the pandemic’s impact on business performance continues to be highly impactful:

Auto care companies appear to have bypassed temporary furloughs in favor of staff layoffs as the month has progressed:

And the overall outlook remains somewhat negative for the next year:

In a future issue, I’ll compare results between different segments of the industry, as well as relative to the manufacturing industry. If you’re looking for interactive economic and industry data at your fingertips, request free access to TrendLens. A full overview of the platform can be seen in this webinar.

Information provided by Auto Care Association

About the Author

Mike Chung

Director, market intelligence at Auto Care Association

Mike Chung is director, market intelligence at Auto Care Association. With more than a dozen years of experience in market research, Chung and his team provide the industry with timely information on key factors and trends influencing the health of the automotive aftermarket and serving as a critical resource by helping businesses throughout the supply chain to make better business decisions. Chung has earned several degrees, including a Bachelor of Science in chemical engineering from Massachusetts Institute of Technology (MIT), a Master of Science in environmental health management from Harvard University and a Master of Business Administration with a concentration in marketing from Montclair State University.