ILR finds trucking tort costs could cost U.S. economy billions per year

Key Highlights

- According to the U.S. Chamber of Commerce Institute for Legal Reform (ILR) and The Brattle Group, high tort costs don't only impact the trucking sector, but the U.S. economy

- They argue that by capping tort costs, similar to laws enacted in Georgia and Florida, states will see higher job growth and GDP

- In a new report, the two orgnaizations used a model to estimate which states would be most impacted by tort law reform and overall economic growth

While the trucking industry has felt the most pain from tort law abuse, to the tune of $58 billion in the U.S. in 2022, a new study from the U.S. Chamber of Commerce Institute for Legal Reform (ILR) (along with The Brattle Group) found that they’re not the only ones. According to the organization’s new report, “Tort Costs in America – Commercial Auto: An Analysis of the Economic Impact of Commercial Automotive Tort Costs,” the costs of the tort system hurts the overall U.S. economy by reducing business investments and spending, dampens broader economic growth, and reduces GP and employment.

For more on tort law and nuclear verdicts:

"As the backbone of the U.S. economy, costs of excessive litigation on the trucking industry not only affect American workers and their employers but have a ripple effect on the entire U.S. economy, impacting industries from agriculture to manufacturing and retail,” said Oriana Senatore, managing director and senior vice president of strategy at the U.S. Chamber Institute for ILR. “Sky-high tort costs imposed on the commercial automobile industry deter economic growth, contributing to declining GDP and lower employment rates. This report demonstrates the urgent need for legislative reform to curb these escalating costs, easing the economic burdens they impose on consumers and businesses nationwide."

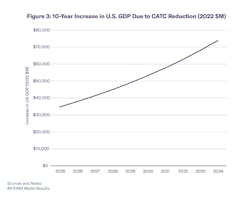

To explore their argument, the two organizations modeled the economic impacts if all states reduced commercial auto tort costs to those of the lowest-cost states. To do so, they used data from three ILR studies that tracked litigation costs in the U.S. After analyzing their model results, the two groups found that every $1 million increase in tort costs reduces the U.S. GDP by about $2 million. Beyond this, they estimated that if tort costs were reduced nationwide, over a 10-year period, the country could see:

- The U.S. GDP increase by an average of $52.3 billion per year

- The creation of 5.7 million additional jobs across economy

- The pace of food-at-home price inflation decrease by up to 15%

How the model works

To gauge the costs of tort law on the U.S. economy, ILR and the Brattle Group used the latter’s “BEYOND” model to look at cost impacts on a state-by-state basis, with a focus on commercial automobile tort costs (CATC). For the study, CATC included household awards, insurance, and legal services, with verdict awards/settlements amounting to 62% of overall liability costs. Then, they reduced CATC in each state (in proportion to commercial automobile transportation revenues) to equal the minimum level in any state, based on the cost in the trucking industry and outside of it.

For the trucking industry, that minimum tort cost per revenue is $25 per $1,000, which is the level in North Dakota. For outside of trucking, that minimum cost is about $1 per $1,000 of revenue, which is the cost in Wisconsin. Based on these caps, ILR found that total tort costs for the trucking sector would have declined by about $6 billion in 2022, representing a 40% drop. Meanwhile with the $1 cap, non-trucking commercial vehicle tort costs would have dropped by about $23 billion (46% drop) in 2022.

With these impacts together and applied to the present, this is how ILR’s model estimated that the U.S. GDP would grow $523 billion over the next 10 years (2025-2034).

State-by-state results

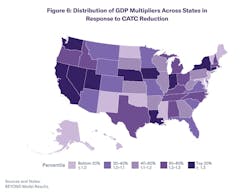

Additionally, LIR and the Brattle Group examined how capping tort costs would impact states individually, especially those with high CATC in trucking and those whose economies depend on trucking.

For instance, the model found that California and Texas have the highest tort costs per $1,000 in revenue in transportation, and thus would see the most benefits from tort cost caps. Plus, the organizations argued that because CATC grew at an average rate of 6.7% per year during the timespan of its data collection (2016-2022), then the U.S. GDP would increase even more if that rising CATC rate was curbed.

Alongside this, the study reported how sensitive state economies were to tort costs, and thus how they could benefit with tort caps. In particular, they noted that states with high levels of large and freight-intensive manufacturing sectors and intrastate commercial automobile transportation would be most affected by CATC caps. For example, they noted that transportation is a large employer in Nebraska, Washington, and Utah, and thus would benefit the most from CATC decreases.

And as case studies, the two organizations cited Florida and Georgia’s tort reforms from 2023 and 2025. While these years weren’t included in the model, Gov. Ron DeSantis said that his state’s insurance reform helped reduce rates by 6.5% in 2025.

About the Author

Alex Keenan

Alex Keenan is an Associate Editor for Fleet Maintenance magazine. She has written on a variety of topics for the past several years and recently joined the transportation industry, reviewing content covering technician challenges and breaking industry news. She holds a bachelor's degree in English from Colorado State University in Fort Collins, Colorado.