2026 fleet M&A guide: Advice, predictions, and '25 movement recap

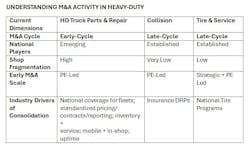

I believe independents are reaching a scale-or-exit fork in the road. As the industry continues to consolidate, increasingly larger, better-capitalized operators are and will command premium valuations. This same playbook occurred in tire & service and collision, but just 5-6 years earlier than it has heavy-duty.

Path one: Continue operating, but scale

Operating as an independent is expected to become increasingly more competitive. While relationships and quality matter, changing customer expectations and scale economics (e.g. buying power) are reshaping the competitive landscape.

In my opinion, scaling vis-à-vis continued growth will be increasingly required to remain competitive and required to avoid loss of value as other assets become increasingly larger and more valuable relative to their peers.

Takeaway: I think owners should be aware that scaling their financial profile, professionalizing the business, and extending the product/service offering is key to enhancing or at least preserving valuation.

M&A to-date broken into three phases

- Phase 1: Early Institutional Investors with investment theses in HD businesses (years ~1995-2015).

- Phase 2: Proof of Concept & Exit - The ROI is proven (~2015-2020).

- Phase 3: Current Phase “The Secret is Out” - Buyers look to copy/paste what’s proven; market share gain is equally important.

Path two: Prepare for a near- or mid-term exit

I believe this a viable path to overcome competitive challenges and to avoid sliding down to the lower end of the heavy-duty parts/service valuation range.

Takeaway: If path two seems to be a more logical approach to the proverbial fork in the road, it’s important to have a confidential conversation with an M&A advisor that has deep experience in automotive-services M&A. Readiness, risk, legacy, and outcome, regardless of whether the exit could be in full or partial, is critical to understand.

My 2026 consolidation forecast and observations

- Independents with >=15% EBITDA margins, steady and not choppy historic growth, low key man risk, and low customer concentrations will be preferred acquisitions targets.

- Private equity deploys a “risk-on” appetite to M&A and deploys idle capital (“dry powder”).

- Bidding wars for quality single and multi-location businesses will enhance owner outcomes as regional and national players seek to gain market share more quickly.

- Operators with mobile services will become increasingly valued to buyers as offering out-of-shop services is very desirable.

Successful M&A/consolidation, particularly sell-side, is about maintaining deal leverage and truly balancing readiness, risk, legacy, and potential outcomes optimally. I hope this column adds clarity, but it often spurs questions like:

- “What will buyers value - and penalize - in my business?”

- “What type of buyer will offer the best overall terms and structure?”

- “What is my valuation?”

- “How will real estate impact a transaction?”

- “How will working capital, debt, and other assets and liabilities impact the deal?

- “Is my company more valuable when combined with another before going to market?”

- “How do buyers think about franchise, single or multi-location operators?”

- “What do you typically see in terms of structure and terms: cash, seller’s notes, equity role, earnouts, escrows?”

- “A buyer has promised me a good offer. Why should I auction off my business through a competitive bidding process?

It is my suggestion to always have a good pulse on your business’s strengths, weaknesses, opportunities and threats so that you have a continued growth plan. Diversifying revenue streams and customers/vendors, investing in technology and people, and having a keen understanding of your financial performance through KPIs and visible bookkeeping is an effective way to increase the value and valuation of your business.

Select 2025 Deal Activity

Fleet Services

- Service C&R Fleet Services → Epika Fleet Services

- WW Williams (previously One Equity Partners) → Brightstar Capital Partners

- Cox Automotive Fleet Services → Amerit Fleet Solutions (New Mountain Capital)

- ARS Truck & Fleet Service → FleetPride

- OTR Fleet Service → FleetPride

- Vector Fleet Management → Amerit Fleet Solutions

- ProBilt Services → Fontaine Modification

- Foster's Truck and Trailer → The Service Company

- Epika Fleet Services, Inc. (formerly Trivest-owned) → Ares Management Corporation

- Majestic Truck Services → Merx Truck & Trailer

- Double Down Heavy Repair → DEUTZ Corporation

- PennFleet + Billy Bob's Repair & Tire → Merged to form True North Fleet Services (Garnett Station Partners)

Distribution

- Wheeler Fleet Solutions → OEP Capital Advisors

- Douglas Truck Parts → Aetna Truck Parts

- FleetPride + TruckPro → Merger (Platinum Equity and American Securities remain owners)

- Texas Trucks Direct → Vander Haag's

- East Coast Truck Parts → 4 State Trucks

Truck Centers / Parts Sales / Suppliers

- Ball Volvo → M&K Truck Centers

- HFI Truck Center → Allegiance Trucks

- Utility Trailer Sales Company of Arizona → Mountain Utility Trailer

- Trucks Inc. → Nuss Truck & Equipment

- Transport Equipment → Bruckner's Truck & Equipment

- Thompson Truck and Trailer → Ascendance Truck Centers

- Lee-Smith Dealer Group → Thompson Truck Group

- Nebraska Truck Center → Floyd's Truck Center

- Magnum Trailer & Equipment → Merritt family of companies

- Halt Fire → Reliant Fire Apparatus

- All Star Equipment → Trailer Equipment

- M.P.N. → LDR Partners

- Badger Truck & Auto Group → Kriete Truck Centers

- General Truck Sales → M&K Truck Centers

- Leeds Transit Inc. → Rush Truck Centres of Canada

- New Way Trucks → Federal Signal Corporation

- Meklas Otomotiv → Infinity Engineered Products (Turnspire Capital)

- D&B Heat Transfer Products → Active Heavy-Duty Cooling Products

- REV Group, Inc. → Terex Corporation

- Motiv Electric Trucks + Workhorse Group → Merger

- Durham-Pentz Truck Center → The Papé Group

- E.M. Tharp, Inc. → Coast Counties Truck & Equipment Company

- Dawson International Truck Centres & Dawson Idealease → Glover International Trucks

- Golden State Peterbilt → Coast Counties Truck & Equipment

- DSI Solutions → Karmak

About the Author

Chandler Kohn

Principal

Chandler Kohn is an investment banker with FOCUS Investment Banking’s Automotive Aftermarket team, where he leads the firm’s Heavy-Duty Truck Parts and Service industry coverage. He advises clients on sell-side and buy-side M&A transactions and capital raising initiatives, with a focus on helping owners scale or successfully transition their businesses.

Kohn is also the host of Know to Grow: A Light to Heavy-Duty Podcast, where he interviews owners, CEOs, and senior executives on best practices and forward-looking strategies for building durable, scalable businesses. The podcast is the only industry-specific platform focused on scalability and valuation within the heavy-duty parts and service sector.

With deep automotive industry expertise, a broad executive network, and extensive transaction experience, Kohn serves as a trusted advisor to small and middle-market business owners pursuing partial or full exits, buy-side strategies, or growth capital solutions.

Coming from a multi-generational family of entrepreneurs whose business employed up to 70 people at its peak, Kohn brings firsthand understanding of the realities of building and operating a small business. This perspective, combined with his deal experience, enables him to create effective one-time private transaction markets for clients, with a focus on readiness, risk, legacy, and outcome.

Kohn lives in Charleston, South Carolina, with his wife and daughter. Outside of work, he enjoys spending time with his family, saltwater fishing, fitness training, and exploring Charleston’s culinary scene. He holds a Master of Science in Finance from Tulane University and a Bachelor of Science in Business Administration from the College of Charleston, and maintains FINRA Series 63 and 79 licenses.