Trucking recession, Yellow bankruptcy impact employment

In early February, as is its custom, the Bureau of Labor Statistics (BLS) released benchmark revisions to its database on payroll employment going back to 2021, including noteworthy changes made to the truck transportation employment (TTE) component of total nonfarm payrolls.

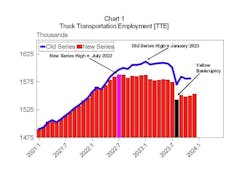

As you can see on the chart below, the latest edition of this series (red bars) was revised downward by about 33,000 people compared to the figures (blue line) that had been previously reported. The details on which sectors of the industry were most revised will not be available for another month.

Of special note was the fact that not only is the high for this expansion smaller than previously reported, it was shown to have occurred in July of 2022, six months sooner than the previous reading of January 2023.

The black bar on the chart marks the month in which the effects of the bankruptcy of Yellow Freight was picked up by the BLS. Note the decline is about the same in both series. The track of employment growth since that event shows a slight upward trend in the current version, whereas it had been flat in the old series.

This chart will look familiar to those of you who have attended MacKay & Company presentations. We use this chart as part of our set of monthly monitors of both the trucking economy and the business cycle.

As you can see on the chart, the downturns in trucking employment have been an important source of information about the likelihood and timing of a downturn in the general economy. The current count of 17 months through January 2024 is the longest on the chart. And while there have been instances of declines in hiring reversing without a cycle peak, none of those instances involve drops of the magnitude we have seen in the past year.

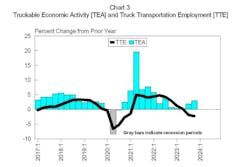

The flattening of the hiring trend in trucking over the course of 2022 and its decline in 2023 are very much in line with what we have seen in the trucking economy as a whole. The chart below tracks both the rate of growth of Truckable Economic Activity (TEA) and TTE.

As you see, the rise and fall of TTE growth is roughly coincident with the rise and fall of TEA growth.

Our preliminary read of TEA in the final quarter of 2024 suggests a slight improvement from the pace we saw through most of the year. But the signal we are getting from TTE suggests that the likelihood of significant improvement in Truckable Economic Activity, or TEA, growth in the near term is quite low. We will have more details on this in the next edition of the TEA newsletter which will be out in early March.

Robert F. Dieli is President and founder of RDLB, Inc. an economic research and management consulting firm based in Lombard, Illinois.

About the Author

Robert Dieli

Economist at MacKay & Company

MacKay & Company specializes in market research for commercial trucking, construction equipment, and agricultural machinery. The company provides strategic research and analysis to vehicle and component manufacturers, distribution and service channels, industry associations, and private equity firms. With a long career managing portfolios and coordinating domestic economic forecasting programs, Dieli began RDLB, Inc. in 2001. In this role, Dieli serves as an advisor to many firms in the trucking, consulting, and financial services sectors. He is also an economist with MacKay & Company.