Diagnostics, hiring techs top pain points for fleets and shops, Noregon finds

Key Highlights

- As has been the case for several years, hiring remains a challenge for shops and fleets.

- Diagnostic accuracy is now a top concern for half of the industry, emphasizing the importance of smarter tools to reduce costly misdiagnoses and comebacks.

- 74% of Class 8 trucks are over eight years old, increasing the need for reliable diagnostic solutions to manage aging fleets.

- Technician-to-tool ratios are tightening, with a move toward more capable, integrated diagnostic tools to support advancing vehicle systems.

- Remote diagnostics and telematics are expanding, enabling pre-emptive repairs and fleet-wide health monitoring, with AI set to further enhance fault triage and technician support.

Noregon Research has released its latest industry report, “Unpacking the Commercial Vehicle Diagnostics Market 2026 Industry Outlook," which combines industry data insights with Noregon's Voice of the Customer survey data. As the fourth of its kind, Noregon can now more clearly glean maintenance trends from 2022 to last year. And what this shows is that fleets, dealerships, and repair shops all still share two common challenges: hiring technicians and accurate troubleshooting/diagnostics.

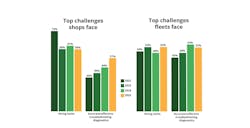

The survey found that 58% of shops and 52% of fleets cited hiring technicians as a major issue, while 51% of shops and 52% of fleets point to troubleshooting and diagnostics as an ongoing concern.

According to Sandeep Kar, chief strategy officer at Noregon, this is because the two problems are closely linked.

"On one side, experienced technicians are retiring faster than new ones are entering the field, and at the same time, the work itself is getting more complex," he explained, citing the electrical interconnectivity of modern commercial vehicles as a big reason for that. "When you don’t have enough experienced techs, accurate troubleshooting becomes more difficult, which drives longer dwell times and more frustration in the shop."

It is worth noting, however, that hiring has become less of an issue on the shop side. In 2022, nearly three-quarters of shops listed hiring as top concern, but has dropped almost 20% over the past three years.

"This suggests some normalization after the extreme labor disruptions of the pandemic era," Kar said, "along with better retention efforts and more structured training pipelines in the shop environment."

The report is based on responses from more than 500 participants across fleets, dealerships, and independent service providers. According to Noregon, “shops” include commercial vehicle dealerships and independent service centers, while “fleets” refer to operations performing maintenance in-house, including private carriers as well as government, municipal, and public safety fleets.

On the troubleshooting side, misdiagnosis, comebacks, and long dwell times are costly disruptions in workflow and have the potential to damage a shop’s reputation with customers. In 2025, roughly half of fleets and shops report diagnostics as a top challenge, up 46% from 2022.

Better diagnostics mean fewer repeat repairs and improved technician productivity, which enables shops to increase output without expanding their workforce.

Aging truck population equals more maintenance

The report also tackles equipment age, rising costs, and overall outlook on the economy.

With increasingly older fleets industry-wide—74% of Class 8 trucks in operation today are over eight years old—reliable service has never been more critical. At the same time, repair and maintenance costs are climbing. ATRI reported that they accounted for about 9% of the total cost of operating heavy-duty line-haul trucks in 2025—a 34% increase over the 2020-2024 period.

This tracks, as trucks with over 500,000 miles can tack on an additional $0.15 per mile in maintenance costs, according to Brian Antonellis, current SVP of fleet operations at Fleet Advantage. This is driven by increased attention to the aftertreatment system, suspension wear, and electrical issues caused by long-term road vibration.

Economic outlook

Economic uncertainty continues to shape how shops should plan for 2026. Fuel, one of the largest variable expenses for fleets, has begun to drop in price after peaking around $0.63 per mile. Lower fuel costs can help alleviate budgets, but pressure in other areas remains top of mind across the industry.

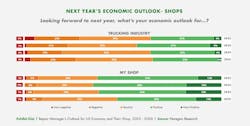

That instability shows up in shop sentiment. Noregon's report found that nearly twice as many respondents in 2025 reported an overall negative economic outlook for their shop when compared to 2024, rising from 5% to 9% YoY. At the same time, optimism is slipping, with 62% of shops reporting a positive outlook in 2024 and only 53% in 2025.

New truck sales reinforce that cautious attitude. At the beginning of 2025, many industry forecasters expected new Class 8 truck sales to hit 300,000 units, but tariffs and a continued freight recession led to a much lower volume. By the end of 2025, an estimated total of 258,000 new trucks were sold in North America.

Looking ahead, Noregon predicts 2026 will dip further to about 245,000 units before rebounding to around 281,000 in 2027, offering some relief for OEMs.

Tool counts steady, but more capability is demanded

Even as diagnostics becomes a bigger focus for shops, this doesn’t mean the number of scan tools in the bay is increasing dramatically. Diag tools and software remain expensive, and in an environment where budgets are tight, managers are seeking quality over quantity. Techs need smarter and more capable tools, not more of them.

Platforms like Noregon’s new ShopPulse, a workflow automation software designed to integrate with JPRO, help to unify diagnostics and shop management. The solution digitizes the entire repair process, simplifying work orders, inventory, invoicing, and more. This illustrates a trend toward more comprehensive tools that, according to Kar, are already taking shape.

"Diagnostic tool providers like us and our peers are looking at anonymized fault and repair data from thousands of shops and fleets to understand what problems show up most often, what tends to get misdiagnosed, and what actually fixes the vehicle," he offered. "That insight gets built back into the tool as clearer fault descriptions, guided test steps, and more relevant repair suggestions."

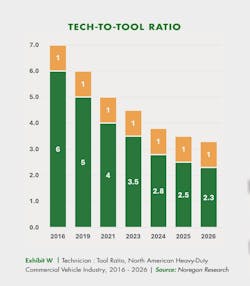

Technician-to-tool ratios are tightening as well. A decade ago, a single scan tool might have been shared among six technicians. This ratio is expected to reach 2.3:1 in the coming year, meaning that there might be one scan tool per two techs in the shop. This reflects the growing digital dependence in modern shops as vehicles become more electrically interconnected.

Kar said the focus is also on making those tools easier to use and reducing friction for techs. "We are constantly simplifying how information is presented—fewer screens, clearer language, intuitive graphics, and more guided workflows that help techs move step by step instead of hunting for answers," he added.

In the years to come, aftermarket diagnostic tools are projected to grow in market share and equal out with OEM tools by 2028, giving shops more options without increasing the amount of tools they own.

Rise of remote diagnostics and AI

Diagnostic processes are no longer confined to the repair bay, as remote diagnostics and telematics continue to help shops plan repairs before trucks arrive. According to the report, 56% of shops plan to maintain remote diagnostics use, while 44% expect their usage of telematics and remote services to increase over the next year.

The capabilities of these tools are expanding as well, with telematics providers moving from basic fault data forwarding to fully integrated diagnostic platforms that offer remote triage, recommended repair actions, and fleet-wide health dashboards, the report stated.

Interest in artificial intelligence continues to rise, with 40% expressing that they were interested/very interested in using AI for fault triage and 38% for AI “mentor” functions, according to Noregon’s 2025 Voice-of-Customer survey.

This is a jump from just a few years ago, with only about 1 out of 3 shops and fleets reporting that they had at least moderate interest in AI in early 2024.

AI is increasingly seen as a labor assistant and productivity multiplier instead of a replacement, with application helping new techs onboard faster, guide repair decisions, and more. Platforms that integrate AI-powered features with diagnostics are helping shops and fleets work smarter, not harder.

About the Author

Lucas Roberto

Lucas Roberto is an Associate Editor for Fleet Maintenance magazine. He has written and produced multimedia content over the past few years and is a newcomer to the commercial vehicle industry. He holds a bachelor's in media production and a master's in communication from High Point University in North Carolina.