Fleets have a lot of big maintenance decisions to make, and perhaps the most impactful is who will do it. Keep it all in-house, outsource all of it, or some of both?

“Most fleets will do at least 35% of their maintenance outside of their own maintenance network, and we see that increasing,” reported Dave Walters, senior solutions engineer for Trimble.

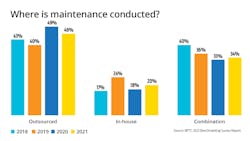

According to the National Private Truck Council’s (NPTC) 2021 Benchmarking Survey Report, nearly half (46%) of private fleets who responded outsourced all their maintenance, while only one in five performed all their own work. This report found fleets that keep most maintenance in-house average 10% longer trade cycles and pay about 7% more per mile for equipment and maintenance.

The biggest business case for outsourcing is being able to conduct business, said Eric Daniels, vice president of truck care for Love’s Travel Stops.

“Uptime is the No. 1 reason we see fleets using outsourced maintenance,” Daniels said. “Out-of-route miles and driver downtime cost money and put a strain on already tight schedules, and these issues can be avoided by using outsourced maintenance providers.”

More than 400 Love’s Truck Care locations offer preventative maintenance and emergency roadside assistance, along with light mechanical services such as repairs for wheel-ends, HVAC, starting and charging systems, electrical and air systems, and trailers.Daniels said another major benefit of outsourcing “is having a consistent maintenance offering regardless of what part of the country a driver is in, whether it’s roadside or at a terminal.”

Each fleet will have a different reason on how and why they approach maintenance outsourcing. Fleet Maintenance collected several industry insights to help fleets understand and make the right business decision for themselves.

The growing fleet

After his fleet doubled in size to ten trucks over the past year, Hell Bent Xpress owner Jamie Hagen began doing the math. “At this growth rate, it’s time to consider if we should be performing maintenance in-house,” he said. “That’s a discussion that we need to have, but there are a lot of moving pieces, so the equation gets complicated.”Running out of Aberdeen, South Dakota, Hell Bent Xpress got its start in 2010. It was then that Hagen, a former company driver for a bulk tank hauler of food grade liquid products, began leasing his services to the carrier and adding tractors to his fleet. Today, Hell Bent hauls tankers and dry vans across the U.S. and Canada with Mack Anthem tractors.

Focused on making sure that his company’s tractors are well-maintained, Hagen handles lubrication, tire work, and some light repairs himself. For anything more complicated, he relies on local Mack Trucks and Utility Trailer dealers.

“We believe it will be less expensive and more convenient to perform maintenance in-house, and we have a mechanic in mind if we go in that direction,” Hagen said. “The question is whether we can justify the expense or if we need to reach 20 or 30 trucks to be able to afford it.”

Hagen is also asking himself if his own time is better spent growing the business rather than managing maintenance and handling some of the work. “What else could I be doing? At what point am I more valuable doing other things?” he asked himself. “That’s not something you necessarily think about when you’re scaling up rapidly, but now is the right time to ask so we know the answer when it’s time to take the leap.”

Balancing both in-house and outsourced maintenance

“We’re outsourcing maintenance where we don’t have the equipment density or where it doesn’t make sense to have our own shop,” said Gerry Mead, executive vice president, maintenance and equipment at Hub Group. “Another way to look at it: Operating a shop can be cost-effective, because that decision affects total cost of ownership.”

Hub Group, headquartered in Oak Brook, Illinois, provides regional, dedicated, and intermodal services with a fleet of 3,000 power units, 6,000 pieces of trailing equipment, and 45,000 intermodal containers. While the company operates from 60 locations, it only has six shops, located in California, Texas, Tennessee, and Georgia, including some with mobile service trucks. A large amount of its maintenance needs are met by dealers and independent tire and service providers.

Keeping maintenance work in-house is a cost-reduction strategy and a means of improving vehicle utilization, Mead noted. However, there are the considerations that have to be balanced against shop capabilities and investment needs.For example, Mead suggested to ask if the maintenance organization has the expertise and tools on hand? Does it make sense to tie up people and bays for certain types of repairs when the goal is to keep vehicles moving through the shop? There is also the question of technician availability, which is increasingly difficult, and the growing need for training and certification.

“TMC offers guidelines on how to calculate things like the number of bays and technicians you’d need based on equipment density,” Mead said. “But the real test of success about outsourcing and in-house maintenance comes from determining the quality of your programs. Measurements of things like the number of repairs between PMs and repeat failures present a true scorecard you can use to make the right choices.”

Calculating in-house vs. outsourced services

Capacity is measured by the number of in-house technicians in relation to the size of your fleet to ensure you have the right balance, related Eric Woltz, garage management system liaison at Holman, parent of vehicle fleet management company ARI. Capability is measured as the expertise and training to work on the entire range of vehicles in your fleet.

“More often than not, infrastructure is the biggest challenge for fleets, from the facility itself to the necessary equipment, tools, parts, and software needed to run an efficient in-house operation,” Woltz said. “When you outsource your maintenance to an external facility, you’re able to eliminate virtually all of these variables, allowing you to focus on your core business rather than worrying about turning wrenches.”

For most fleet operators, a hybrid approach to maintenance—operating an in-house facility that is supplemented by external vendors—can help you strike an ideal balance, noted Joseph Smith, supervisor, truck account administration at Holman.

“We typically advise our customers to use in-house resources for their highly-specialized vehicles that are most critical to maintaining business operations,” Smith explained further. “For units that are less business-critical and for routine maintenance services, partnering with an external vendor is often more efficient, more cost effective, and significantly reduces your administrative burden.”The different sides of the equation about outsourcing and in-house maintenance operations, according to Mike Dickinson, VP of sales for Cox Automotive Mobility Fleet Services (previously Dickinson Fleet Services and Interstate Truck Center), is a reason some clients have both types of programs. The majority, however, outsource 100% of their service activity, he said.

Cox Automotive Mobility Fleet Services, a recently introduced entity, not only unifies brands but also signals what the company sees as the evolution of scheduled and unscheduled maintenance solutions for fleets. The combined workforce of the fleet services group includes more than 1,100 technicians, nearly 800 mobile service trucks, and over 25 shops. Collectively, they offer on-site, emergency mobile, and shop services for light-, medium- and heavy-duty trucks and trailers.

“More fleets are transitioning to this service model once they educate themselves about the challenges that come with in-house maintenance,” Dickinson said. “For starters, the industry’s significant technician shortage is likely to continue for the foreseeable future. Outsourcing takes the burden of recruiting, training, and retaining technicians off their plate. And from a training standpoint, vehicles are more complex, and more diagnostic equipment is needed. With outsourcing, that’s on the provider.”

Fleets should use metrics that are relevant to their operation to decide about outsourcing and to ensure providers are meeting their needs. Understanding what your technicians can do in your facilities in a given amount of time, training costs and time requirements, the investment required in shop tools and technologies, and vehicle uptime rates all help you make an effective decision, Dickinson advised. They can also be used to challenge the provider to do better by providing for accountability.

In some ways, the decision to outsource maintenance is about opportunity costs. Fleets need to focus on what they do best, whether it’s hauling freight, delivering packages, or providing services. The question is whether managing in-house shops distracts you from what you can do to drive profitability.

That’s part of the message from Jim Lager, executive vice president of sales and rental for Penske Truck Leasing. “Deciding to outsource is a fleet utilization play,” he said. “It’s about improving uptime, and at the same time a fleet’s ability to hire and keep drivers. That is absolutely tied to vehicles. Drivers need trucks to be running to make money, so maintenance has an impact on their satisfaction and retention.”

Not that long ago, operating 50 or 60 power units was enough scale to justify in-house maintenance, Lager noted. Today, fleets of that size, and even larger operations, can see value in outsourcing.Furthermore, current industry issues are driving interest toward outsourcing maintenance. “Delays in deliveries of new vehicles means running equipment longer, and parts may also be harder to procure,” Lager said. “Individual fleets may not have as much leverage with manufacturers and parts suppliers, but when they have a maintenance partner with full-time procurement expertise, they get more support.

“That’s especially true as trucks get older,” Lager added. “If you’re extending a full-service lease, you have the security that the truck will be kept running at a predictable cost. In that case, having a partner is better than going it alone.”

Lager also said that Penske is seeing growth in the number of fleets who are looking for maintenance alternatives by turning over their on-site shops to the provider. The practice, he pointed out, removes service delays and increases vehicle availability while providing the support fleets can expect by outsourcing to qualified service providers.

Monitoring and measuring maintenance

“A fleet information system that maintains the service schedule of assets and uses fault code information, DVIR reports, and chronic repair alerts helps you be better prepared to monitor the health of your equipment,” Trimble’s Walters said.

Metrics that Walters advised fleets to follow when assessing the effectiveness of their maintenance programs include PM compliance, chronic repairs, downtime, frequency as a measure of repairs performed on an asset between preventive maintenance services, and over the road breakdowns.

“An increase in frequency quickly identifies a problem program or may be linked to certain repair work being outsourced,” Walters continued. “Fleets should also be monitoring asset downtime, which could be impacted positively or negatively due to outsourcing maintenance activities.”Fleet maintenance software facilitates that process, and can do so in real time, Walters noted. Through the repair order creation process, whether for internal or external repair work, for example, the software can alert the fleet to preventive maintenance services that are coming up or are overdue, warranty status of the asset, job, or part, and if a chronic repair issue exists. The information allows the fleet to make informed decisions about where the service should take place.

Additionally, advanced reporting tools allow fleets to customize KPIs and metrics to their fleet’s specific needs, and simplify access to data in an informed, user-friendly environment. In combination with those capabilities are information tools for technicians, which empower them to make better decisions based on a vehicle’s repair needs and parts availability, as well as its warranty status.

For outsourced maintenance, it is very important for fleets to know and track out-of-service times and repair costs, related Jake Schell, associate product manager for the Mitchell 1 Commercial Vehicle Group. Truck repair software can be used to evaluate the expected time and cost of repairs against the actual time and cost of the outsourced jobs.

“A full suite of programs that empowers the fleet to ensure its vehicles are being properly maintained provides a way to track maintenance and repairs on vehicles flowing through fleet and outsourced service provider shops,” Schell said. “As this data is collected, the fleet can access reports to make informed decisions. For example, knowing the time needed to perform repairs is a powerful way to enable the fleet to better balance workload and reduce downtime.

“The metrics a fleet chooses to collect depends largely on what goals it hopes to attain,” Schell added. “Nevertheless, there are basic metrics that will provide insight to the overall effectiveness of the maintenance program, whether it’s in-house or outsourced.”

Those metrics, according to Schell, include repair times per job, parts costs, when specific problems develop based on time or mileage, and technician performance in completing jobs in the estimated time, as well as comebacks. There is also the amount of time a vehicle spends in the shop—not only the time to perform the service but also how long the vehicle was in the shop waiting.

Patrick McKittrick, CEO at heavy-duty repair shop software provider Fullbay, pointed out that fleets need to get a true cost of ownership for their equipment and make sure it’s safe to be on the road. “That’s only going to be possible by getting accurate and timely data from repair providers,” he said. “If a fleet knows exactly what work is being performed, and that required inspections and maintenance intervals are being met, they’ll be able to avoid compliance headaches and issues.

“Uptime is the name of the game, but with a manual process it’s hard to understand,” McKittrick added. “Plus, by understanding what parts are being used and the frequency of breakdowns, they can start to optimize their spec’ing process.”

True cost of ownership, cost per mile, uptime, and safety are the most important maintenance metrics to follow, McKittrick noted. If a fleet’s service provider is not being used effectively and preventive maintenance is delayed or is not keeping up with manufacturer recommendations for processes and intervals, they might think they’re saving money. In reality, they could face unexpected downtime, unsafe equipment, or invalidated warranties.

“Repair shop software creates a closed loop between the shop and the fleet, sending data back and forth,” McKittrick stated. “It facilitates communication about real-time status so the fleet has full transparency. With analytics that can be used for predictive insights, they’ll be able to maintain safer and more profitable fleets.”

About the Author

Seth Skydel

Seth Skydel, a veteran industry editor, has more than 36 years of experience in fleet management, trucking, and transportation and logistics publications. Today, in editorial and marketing roles, he writes about fleet, service, and transportation management, vehicle and information technology, and industry trends and issues.

![“Outsourcing takes the burden of recruiting, training, and retaining technicians off [a fleet’s] plate,” said Mike Dickinson, VP of sales for Cox Automotive Mobility Fleet Services. “Outsourcing takes the burden of recruiting, training, and retaining technicians off [a fleet’s] plate,” said Mike Dickinson, VP of sales for Cox Automotive Mobility Fleet Services.](https://img.fleetmaintenance.com/files/base/ebm/fm/image/2022/04/16x9/Cox2.6255edace8fd9.png?auto=format,compress&fit=max&q=45?w=250&width=250)