Nearly all fleet managers agree on fuel card benefits, but one in three don't use, Shell says

Fuel accounts for the second largest chunk of cost per mile, according to ATRI, and a significant portion of a fleet’s overall fuel spend might not even be going into their trucks. Motive estimated 5% of fuel costs are fraudulent. To help prevent theft and get a better sense of fuel expense data, a majority of fleets have provided their drivers with fuel cards.

These provide real-time alerts, and would notify a fleet manager if a charge exceeds the normal amount. This means it would detect if a driver swipes the card, fills up as usual, and then hands the nozzle to his buddy so they can top off their pickup. More than that, the data provides actionable intel managers can use to improve operations.

On the latter point, nearly all fleet managers (95%) agree fuel cards do offer valuable insights into efficiency, according to Shell Fleet Solutions’s 2025 State of Fleet Cards report. The report, which surveyed 260 U.S. fleet managers, also found about two out of every three fleets (62%) leverage fuel cards. Other ways to track fuel expenses include fleet management systems, mobile apps, and integrated telematics systems.

Benefits of fuel cards

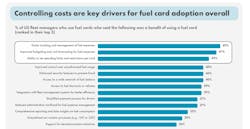

According to the Shell report, some primary cost-control benefits fuel include:

- Fuel-efficient driving practices (50%)

- Regular vehicle maintenance (47%)

- GPS route optimization (43%)

Specific fuel expense benefits included:

- Easier tracking and management

- Improved budgeting and cost forecasting

- Ability to set spending limits and restrict card use

- Control over unauthorized usage

For more on fuel expenses and fuel cards:

However, Shell also found that 28% of fleets struggle with consolidating fuel data for analysis, and over one in four fleet managers said they had inadequate technology and tools to monitor their fuel use. Both issues add to the challenge of reducing fuel expenses for fleets, especially for large fleets. According to the company’s report, 40% of large fleets reported that cost reduction was a challenge, while 38% noted data complexity was an issue. Meanwhile, 29% of smaller organizations found cost-reduction initiatives, compliance with environmental regulations, and inconsistent driver reporting to be problems when it came to managing fuel expenses.

Barriers to adoption

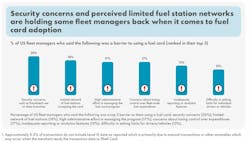

If two out of three fleet managers are using fuel cards, that means one in three is not, depite a large portion of non-adopters acknowledging these cards improve fleet efficiency. Some barriers to adoption are perceived lack of security, limited station acceptance, and administrative burdens.

Security risks are major concern for even those who do use fuel cards, and the reason why 75% of the total repondents said they were hesistant about adopting digital fuel cards.

Currently, Shell overs two options for its fuel card, the Shell Card: Shell Card Business and Shell Card Business Flex. Both offer access to Shell’s Station Network, fuel rebates, fleet rescue service, discounts on vehicle maintenance from Jiffy Lube, and access to fuel data through ClearView Data Analytics. Flex also allows users to access public EV charging networks and supports at-home EV charging with residential electricity rates.

About the Author

Alex Keenan

Alex Keenan is an Associate Editor for Fleet Maintenance magazine. She has written on a variety of topics for the past several years and recently joined the transportation industry, reviewing content covering technician challenges and breaking industry news. She holds a bachelor's degree in English from Colorado State University in Fort Collins, Colorado.