OEM and aftermarket tools evolve to tackle latest aftertreatment issues

For many technicians, the aftertreatment system is one of the most challenging systems to work on, partially because it has developed so much (and continues to do so) over the past few years. From keeping up on current service and component updates to remembering details from past aftertreatment iterations that still might be on trucks, there's a lot to keep track of.

That's why it's so important to make sure technicians have the tools they need to diagnose and troubleshoot aftertreatment systems, whether they're included on the truck or come from the aftermarket.

On-vehicle tools

Even when a tech is highly trained and knows how to get to the root cause, they still need accurate data coming from the vehicle via vehicle health data and diagnostic trouble codes. And to interface with all that data, the shops need the right tools to take their diagnosticians to the next level.

On the vehicle, this starts with remote diagnostics, which OEMs made a standard feature in 2011, shortly after the modern emissions system mandates. For example, Daimler Truck North America (DTNA) has Virtual Technician, Mack has GuardDog Connect, and Kenworth and Peterbilt use Paccar’s SmartLINQ. International’s was OnCommand Connection, but with the rebrand it’s My International now. Volvo just calls it Remote Diagnostic (those Swedes are a direct bunch). These all provide realtime health, fault codes, and historical sensor data from the engine and aftertreatment systems. They also give techs a headstart.

“Alongside fault data, remote diagnostics solutions also share convenient, accessible information about the code: what it means, how urgent it might be, and the likely parts and services necessary for repairs,” related Magnus Gustafson, VP of connected service at Volvo Trucks North America.

The DTCs—one code or a specific combination—could also trigger an alert in a fleet maintenance platform integrated with predictive maintenance. Based on the severity, the driver might be directed to pull over or venture to the nearest repair facility to avoid catastrophic engine failure.

In less severe cases, this information still helps fleet managers and technicians speed up intake and increase uptime, noted Patrick Wallace, Peterbilt marketing manager for zero-emission and connected trucks.

Dealers, large fleets, and leading third-party repair vendors may also have access to certain OEM-specific scan tools and software to speed up troubleshooting.

For example, DTNA has developed an AI-powered tool for its Uptime Management Suite called Techlane. According to the company, this tool helps techs speed up troubleshooting and root cause analysis, repair, and warranty processes. The generative AI also helps techs complete repair orders and invoices.

“Techlane maximizes uptime for customers by consolidating AI-based diagnostics, technical information, and repair processes specific to the vehicle being repaired,” offered Paul Romanaggi, GM of CX and Service at DTNA. “With this new technology, we are not only driving increased efficiency for existing technicians but also attracting a new generation of technicians who thrive on this technology.”

The solution is already deployed at more than 500 dealers and used by several thousand techs.

“For our new or less experienced technicians, the true benefit in Techlane is bringing resources to a central location so they don’t have to constantly hunt for answers,” said Jerry Kocan, president and GM of Four Star Freightliner in Alabama. “They can reduce time spent out of the bay and be more productive. For our highly experienced technicians, we are seeing an average of 10% efficiency increase, with some achieving an even greater increase of 25% or more.”

Aftermarket on the rise

While this advanced solution is just getting started with the Class 8 market leader’s dealer techs, it won’t be long until the AI-enabled diagnostic technology trickles down to smaller fleets and independent repair shops. The aftermarket already provides tools such as all-make remote diagnostics to get ahead of issues like an unexpected derate, such as Jaltest Telematics or Noregon TripVision.

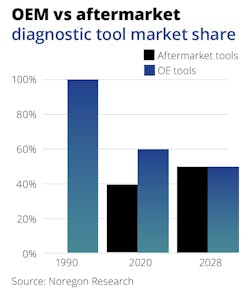

And because of the prevalence of mixed fleets, shops are trending toward adopting all-makes scan tools. OEMs had 100% market share in 1990, but according to Noregon estimates, the aftermarket will be even by 2028.

“All-make multi-protocol scan tools are very intuitive in today’s market; the techs get the advantage of one software interface to learn instead of multiple different operations and layouts of OEM software per brand,” NationaLease’s Sam Lord, director of maintenance and telematics at Kirk NationaLease, noted.

He explained that OEMs use multiple branded components between the ABS, transmission, and powertrain systems, and each has its own interface. Aftermarket tools, meanwhile, offer a comprehensive and efficient alternative.

“With all-make software such as Jaltest, there is no reconnecting different software for each component and the functions, layout, and operations remain the same through a single connected interface session,” Lord said.

He added the all-makes scan tools help the NationaLease shop “troubleshoot issues and complaints faster and more accurately with features like guided diagnostics,” as well as perform vehicle VIN decoding, bidirectional commands for resets, and forced regens.

It should be mentioned that the number of diagnostic tools is rising. As of last year, Noregon estimated the diag tool-to-tech ratio was 1:3, with an even distribution coming by the end of the decade.

Bruno Gattamorta, chief commercial officer for Cojali, agreed the ratio will be 1:1 by 2030. “You’re not going to be able to do anything without these tools in the future. As time goes on, there are more sensors and more ECMs,” he told Fleet Maintenance last year.

Lord thinks this is a “fair estimation.” He added, “From our team’s standpoint, the diagnostic tool is a required shop tool no different from a jack or tire tool, and we will continue to provide our team with the best and most complete software tooling available today as a shared resource.”

And the aftermarket is starting to consolidate all that all-makes data. For instance, Noregon made a big move last year by releasing its shop management platform, ShopPulse, to bring vehicle and repair data into one platform, helping managers get a better overall view of vehicle and technician efficiency.

Noregon believes this is the future for aftermarket repair, one where “shops complete diagnostics and service automation in a single pane of glass.”

The aftermarket continues to integrate shop management platforms with repair guidance. Most recently, Fullbay, a platform used by many heavy-duty independent shops, integrated with Mitchell 1. This allows users to standardize labor estimates, diagnostics data, and interactive wiring diagrams to further cut time-consuming actions in the shop, which will help managers track key performance metrics better and take a bite out of dwell time.

Looking ahead, the next best diag tools could be worn by the technician. This year Cojali unveiled Jaltest Diagnostics AR, an augmented reality platform running off the Magic Leap 2 smart goggles. This allows techs to work on the vehicle without losing sight of the computer screen, which appears on the wearable device’s lenses. The tech can interface with that screen with hand gestures, and at some point, via voice commands.

“Imagine a repair on a Cummins engine related to the SCR system, such as a fault code 3232, which refers to NOx sensors,” said Jorge Verdejo, sales director at Cojali USA. “Thanks to Jaltest AR, the technician can clearly identify the sensor and verify whether it’s connected correctly. They can view its exact location, what it looks like, and where it should be connected, including wires, pins, and connections.”

Expected in shops in 2026 or ‘27, the AR tool also could help with uptime and recruiting.

“When we look at the new generations, we need to speak to them in their own language...digital, fast, and hands-on—making it easier to diagnose and fix emissions problems from day one,” Verdejo said. “There’s no way they will read a PDF to learn, but they love videogames. The augmented reality experience, interactive steps, and visual guides create a gamified, intuitive workflow that speeds up learning and improves accuracy.”

Looking ahead to '27

Though not an immediate priority, shops should think about how and when they will train techs for the MY2027 engines and aftertreatment systems.

Cummins, for example, is adding a Twin Module Aftertreatment System, which comes with a separate belt-driven 48V alternator to heat the aftertreatment components. Among new variations, in-cylinder (late injection) will also be used at times to raise exhaust temps.

Daniel Meadows, Cummins HD VPI Customer Care, said the new electric heating system won’t require scheduled maintenance.

“Troubleshooting will be handled with a combination of Control Systems Diagnostics, similar to current product support today through measurements taken by the ECM, MGU, & HCU sensors,” Meadows said. “Through the out-of-mission service bay diagnostic tests, the performance of the heaters and 48V systems will be run through a standard cycle, then measured against how they perform against the respective heating cycles. Standard wire harness troubleshooting will be used in the instances of shorted wiring.”

Learning all this sounds complicated, but techs already certified on the X15 engine only need to complete Cummins’ Virtual College and Virtual Short course trainings to become certified on the new engine, Meadows added. Hands-on training will also be available.

The other OEMs will reveal more details on their compliant engines closer to launch, but Nick Smith, International’s media relations manager, did say the S13 “will retain approximately 90% of its current componentry, so changes to tools and training are expected to be minimal.”

About the Author

John Baxter

John Baxter is a freelance truck journalist and serves as the technical director of Advance Diesel Concepts, a small venture that is developing a stratified-charge-compression ignition combustion system that will shortly be tested at Argonne National Laboratory. He is a full member of SAE International and a member of the Truck Writers of North America (TWNA) and serves on its Technical Achievement Award committee. Over his long career, he has been employed by a number of the major truck industry publications.