ATRI Top Concerns: Fleets focus on economy, lawsuit crisis, and less on driver shortage

Key Highlights

- ATRI found that the economy and predatory lawsuits are the trucking industry's top concerns for this year

- The ongoing freight recession has added to economic worries in the trucking industry, as has the state of the total U.S. economy

- However, the driver shortage has fallen off the ATRI's list of top concerns entirely, likely due to falling trucking employment and the freight recession

SAN DIEGO, California—The trucking is currently plagued by no end of worries, chief of which are economic concerns and the three-year-old freight recession. But the eocnomy is by no means alone in trucking's consciousness, as it is followed by legal and regulatory stressors, according to the American Transportation Research Institute’s (ATRI) annual ranking of trucking’s most pressing issues during American Trucking Associations’ (ATA) annual management conference.

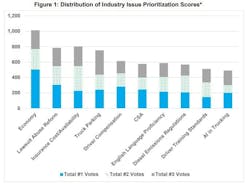

Heading into 2026, the economy is still the industry's top concern for the third year in a row, said ATRI President Rebecca Brewster. But the litigation ecosystem now poses the greatest threat to fleet stability, with lawsuit abuse reform climbing one spot to No. 2—its highest ranking in the 21-year history of the survey—followed by insurance cost/availability, which moved up one spot to No. 3.

The rankings come from a survey of more than 4,200 trucking industry stakeholders, including fleet executives, drivers, suppliers, and law enforcement, with the surveyed group increasing by 14% over the 2024.

“We’re in the third year of this extended freight recession, and the pain is real,” Andy Owens, president of A&M Transport, said. “Operating costs climbed to their highest ever at the same time that freight pricing has bottomed out. ATRI’s annual analysis is so critical for our industry to not only quantify the issues but, more importantly, to understand what we can collectively do as an industry to address each.”

Yet while the trucking industry has operated through upheaval and uncertainty throughout 2025, one industry issue has become less pressing. The driver shortage, a common concern for the trucking industry for decades, has continued to drop in ATRI's rankings. It dropped to No. 9 in the ATRI's list of top concerns in 2024, and now, it fell to No. 12 overall in 2025, dipping beyond the top-10 issues for the first time in the survey’s 21-year history.

At the same time, total trucking employment—and driver employment specifically—continued to fall in 2025 amid layoffs, market exits, and bankruptcies. Taken together, the freight recession also explains the waning concerns about finding drivers. After all, freight rates and tonnage have remained stagnant across the industry, but per-mile trucking costs are rising faster than inflation. This is what the ATRI study called “a perfect storm that is squeezing fleet operating margins and necessitating extensive cost-cutting measures.”

But the economy is also keeping freight capacity reductions from translating into improved rates, according to ATRI’s survey. And to make matters worse, the U.S. economy became more uncertain in 2025 as well. For instance, 2025's economic headwinds included:

- Manufacturing production surpassed 2024 levels but not 2022 levels.

- Housing starts continued to falter, primarily due to higher mortgage rates.

- The labor market cooled over the year, with unemployment reaching 4.3% in August for the first time since 2021.

- Monthly inflation rates remained below 3% in 2025, despite trending upward since April, while disposable personal income growth decelerated.

- Retail sales, after remaining flat during the first half of 2025, rose over the summer months. In August, however, the rate of retail sales growth surpassed that of disposable income, driven mainly by record-high consumer debt levels, with the consequence possibly being limited retail sales going forward.

These economic headwinds also underscore truck drivers’ growing concerns over compensation. Accelerating the adverse operating environment are rising risk costs, ATRI found:

- Insurance premiums rose by an additional 3% per mile in 2024, consolidating the previous year’s 12.5% increase.

- Additional data suggests that insurance renewals during the first half of 2025 rose nearly 10%.

- Despite preliminary data suggesting a fourth straight annual decrease in large truck crashes, insurers continued to experience unprofitability in the commercial auto segment due to rising loss severity, increasing claims costs, and the impact of social inflation on litigation.

- In response, litigation reformers notched victories in nine states thus far this year—including damage caps, eliminating phantom damages, and third-party litigation funding disclosures—but still face counter-reform headwinds from the plaintiff bar.

Government focus also underwent significant shifts after President Donald Trump returned to the White House, seeking to reverse some of the regulatory priorities of President Joe Biden’s administration. These federal policy changes created new uncertainties and opportunities for trucking, ATRI noted:

- Tariffs and ambiguity over their implementation could contribute to inflation and influence consumer demand over the coming year.

- Truck-tractor import tariffs of 25%, currently scheduled for November 1, are poised to significantly increase motor carriers’ equipment costs, which are already up about 50% in the last five years.

- The Environmental Protection Agency (EPA) acted to rescind various vehicle emission rules about NOx, electric vehicle mandates, and the EPA’s authority to regulate emissions altogether.

- Amid a flurry of its own regulatory activity, the U.S. Department of Transportation set new English language requirement guidelines for truck drivers that saw early measurable enforcement impacts.

The trucking industry faced severe challenges and upheavals in 2025 and faces even more in the year to come, according to thousands of survey participants. Responding to these challenges will require the collective efforts of motor carriers, state and federal associations, governmental agencies, and industry suppliers, ATRI said.

Top 10 trucking industry concerns going into 2026

The 2025 survey respondents were composed of motor carrier executives (46%), professional truck drivers (30%), and other freight stakeholders (23%). For the third year in a row, the whole stakeholder group ranked economic concerns above all others. The complete report can be downloaded at truckingresearch.org.

Here is a look at this year’s respondents’ view of trucking going into 2026:

1. Economy (No. 1 in 2024)

For the third straight year, the economy was the top-ranked issue. ATRI researchers noted the combined impacts of rising operational costs (non-fuel costs at a record-high $1.779 per mile) and the prolonged, three-year freight recession are leading to more carrier bankruptcies.

2. Lawsuit abuse reform (No. 3 in 2024)

Lawsuit abuse reform rose one spot to reach its highest ranking in history. It reflects the ongoing crisis of “nuclear verdicts” and the tactics employed by the plaintiff bar. The top strategy is to promote state-level reform, specifically to cap damages paid to plaintiffs and eliminate “phantom damages.”

3. Insurance cost/availability (No. 4 in 2024)

Up one spot from last year, this issue is now back at No. 3, where it ranked in the inaugural 2005 survey. Insurance premiums continued to rise (up 3% per mile) in 2024. Report authors cited the link between excessive litigation and the soaring financial losses of motor carriers and insurers.

4. Truck parking (No. 2 in 2024)

The lack of available truck parking fell two spots overall but remains a critical infrastructure challenge, ranking second among truck drivers’ most crucial issues. The preferred industry strategy is to advocate for a dedicated federal funding program to increase capacity at freight-critical locations.

5. Driver compensation (No. 5 in 2024)

Driver compensation held its No. 5 ranking overall and was the top concern for truck drivers. Driver wages rose by just 2.4% in 2024, half a percentage point less than inflation. While drivers cast most votes for driver compensation, 8.1% of carriers included it as well, which ATRI authors said reflects the challenge of continuing to increase driver pay amid lower freight volumes and declining rates.

6. Compliance, Safety, Accountability (CSA) (No. 7 in 2024)

The Federal Motor Carrier Safety Administration’s (FMCSA) Safety Measurement System rose one spot this year. Carriers still have concerns about its accuracy, particularly regarding enforcement disparities across different states. The industry’s preferred strategies include encouraging FMCSA to address these enforcement variations and speeding up the DataQ process.

7. English Language Proficiency for drivers (New to Top 10)

English Language Proficiency (ELP) was added to the list following a significant number of write-in votes in 2024 and ranks as the third most pressing concern for truck drivers. An executive order by President Donald Trump, requiring new guidance to ensure drivers “read and speak the English language sufficiently,” helped bring this concern more attention earlier this year. The top strategy is to close gaps in CDL training and testing, according to research authors.

8. Diesel emissions regulations (New to Top 10)

Debuting at No. 8, diesel emissions regulations supplant previous anxieties over zero-emission vehicles, which tumbled all the way to No. 23 this year. The focus is on the heavy-duty NOx rule for model year 2027 trucks, which industry leaders expect will substantially increase the cost of new equipment. The preferred strategy is to identify the full financial impacts associated with regulatory compliance.

9. Driver training standards (New to Top 10)

Concerns about driver training standards garnered enough votes from all respondents to rank No. 9 overall, though it has been on the truck driver list since 2019. ATRI’s report said it reflects the belief that new entrants are not adequately trained to operate commercial vehicles safely. The top strategy is to advocate for an FMCSA audit of its Training Provider Registry to ensure compliance with the Entry-Level Driver Training (ELDT) rule.

10. Artificial intelligence (New to Top 10)

The fourth issue to debut on this year’s list, artificial intelligence (AI), reflects the industry’s increasing immersion in technology. Concerns center on potential job elimination and AI-enabled fraud and theft. The top strategy is to research the role and applications of AI, including its positive and negative impacts on the labor force.

How fleet executives and drivers diverge

Motor carriers’ top 10 issues of 2025

The ranking highlights the executive focus on financial and legal stability, with the driver shortage remaining a key concern.

- Economy

- Lawsuit abuse reform

- Insurance cost/availability

- CSA

- Driver shortage

- Driver retention

- Driver distraction

- Diesel emissions regulations

- Truck parking

- Broker issues

Commercial drivers’ top 10 issues of 2025

The drivers’ list remains intensely focused on day-to-day welfare, with driver compensation and truck parking among their top concerns.

- Driver compensation

- Truck parking

- English language proficiency for drivers

- Broker issues

- Detention/delay at customer facilities

- Artificial Intelligence in Trucking

- Driver training standards

- Autonomous trucks

- Electronic logging device mandate

- Diesel emissions regulations

About the Author

Josh Fisher

Technology Editor

Editor-in-Chief Josh Fisher has been with FleetOwner since 2017. He covers everything from modern fleet management to operational efficiency, artificial intelligence, autonomous trucking, alternative fuels and powertrains, regulations, and emerging transportation technology. Based in Maryland, he writes the Lane Shift Ahead column about the changing North American transportation landscape.